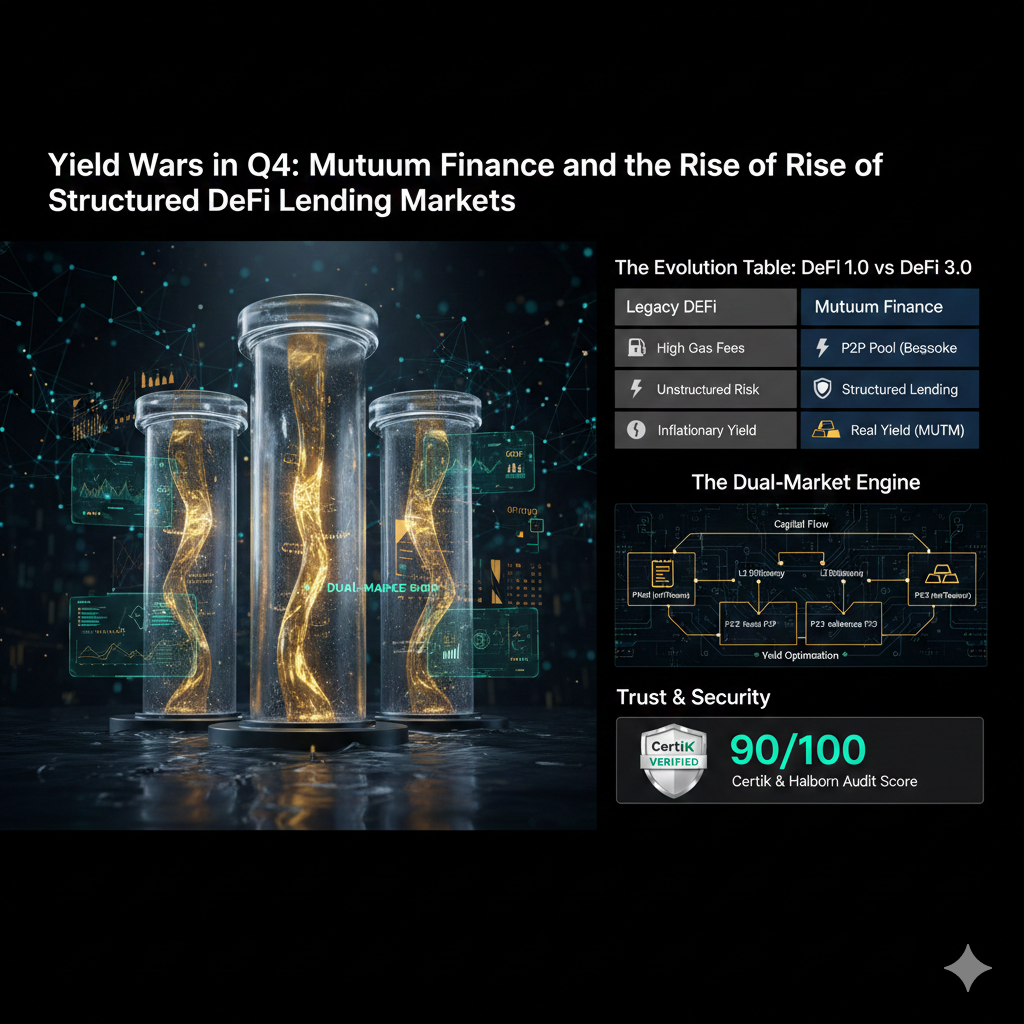

TL;DR: Q4 2025 marks DeFi’s transition from inflationary "farm-and-dump" schemes to sustainable Real Yield. Mutuum Finance (MUTM) leads this shift, leveraging a $19.5 million presale to debut a dual-market "Structured Lending" architecture that bridges institutional stability with retail capital efficiency.

Who This Is For

- Institutional Investors: Those requiring MiCA-compliant frameworks and bespoke P2P lending terms.

- Yield Farmers: Participants pivoting from speculative rewards to yield generated by organic borrowing demand.

- Retail Users: Small-scale lenders seeking low-fee entry points via Layer-2 integration and fiat on-ramps.

Our Verdict

Mutuum Finance is the most robust lending protocol entering the market in Q4. While competitors struggle with liquidity fragmentation, Mutuum’s Dual-Market Engine successfully captures both the high-volume efficiency of Peer-to-Contract (P2C) pools and the precision of Peer-to-Peer (P2P) agreements. Its $19.5 million capital raise and high security ratings establish it as the primary benchmark for DeFi 3.0.

The 2025 "Yield Wars" focus on resilience. As the Federal Reserve executes its third rate cut of the year, investors are fleeing unsustainable triple-digit APYs in favor of high-quality, "real" yields. Mutuum Finance (MUTM) fills this vacuum by integrating a dual-market architecture with Layer-2 efficiency and a rigorous security framework.

The Macro Landscape: A Flight to Quality

Investors now prioritize protocols where yield derives from genuine economic activity. This mandate drove Mutuum Finance’s $19.5 million presale, attracting 18,600 individual holders before its V1 launch. This participation signals a definitive market shift toward structured assets over speculative tokens.

Regulatory clarity via the GENIUS Act and MiCA has established the necessary legal guardrails for institutional entry. In this "Institutional Era," protocols must mirror the reliability of traditional financial systems to remain competitive. Mutuum Finance meets these standards by aligning decentralized transparency with professional-grade risk management.

Technical Analysis: Dual-Market Architecture

Mutuum Finance replaces the fragmented liquidity models of DeFi 1.0 with a Dual-Market Engine. This system employs two interconnected models to maximize capital efficiency:

- Peer-to-Contract (P2C): Lenders deposit assets into shared pools and receive mtTokens (e.g., mtETH). These assets appreciate against the underlying collateral as interest accrues, providing continuous liquidity.

- Peer-to-Peer (P2P): This model facilitates bespoke loan terms for high-net-worth individuals and institutions, allowing for direct matching on duration and interest rates.

A Dynamic Interest Engine governs the protocol. It adjusts borrowing costs in real-time based on utilization ratios. Risk management relies on tiered Loan-to-Value (LTV) ratios—75% for stablecoins and 60% for volatile assets—monitored by automated liquidator bots to ensure solvency during market volatility.

UX and Accessibility

The protocol eliminates the traditional hurdles of gas costs and onboarding complexity. By deploying on Layer-2 (L2) solutions, Mutuum bypasses Ethereum mainnet congestion. Direct fiat-to-crypto on-ramps remove the need for complex manual bridging, making the ecosystem accessible to non-native users.

"Security is the product. With a 90/100 CertiK score and an active $50,000 bug bounty program, Mutuum addresses the trust deficit that previously hampered retail DeFi adoption."

Ecosystem Expansion

The protocol is developing a USD-pegged stablecoin backed by overcollateralized borrower interest. This native asset keeps liquidity within the ecosystem and compounds rewards for MUTM holders. The upcoming Sepolia V1 Testnet launch marks the final phase before cross-chain expansion into EVM-compatible chains and Solana.

Future Outlook

The convergence of AI and DeFi is imminent. Mutuum’s roadmap includes AI-driven risk management to predict yield opportunities and adjust liquidation thresholds based on market telemetry. As DeFi yields continue to outperform traditional fixed-income assets, Mutuum’s infrastructure provides the foundation for future DeFi-backed Exchange Traded Products (ETPs).

Key Takeaways

- Real Yield Primacy: Capital flows toward organic borrowing activity rather than inflationary emissions.

- Structural Superiority: The P2C/P2P hybrid model offers better flexibility than single-pool competitors.

- Regulatory Readiness: Compliance with MiCA and high security scores are now baseline requirements for leadership.

- Scalability: Layer-2 integration is mandatory for retail adoption and fee reduction.