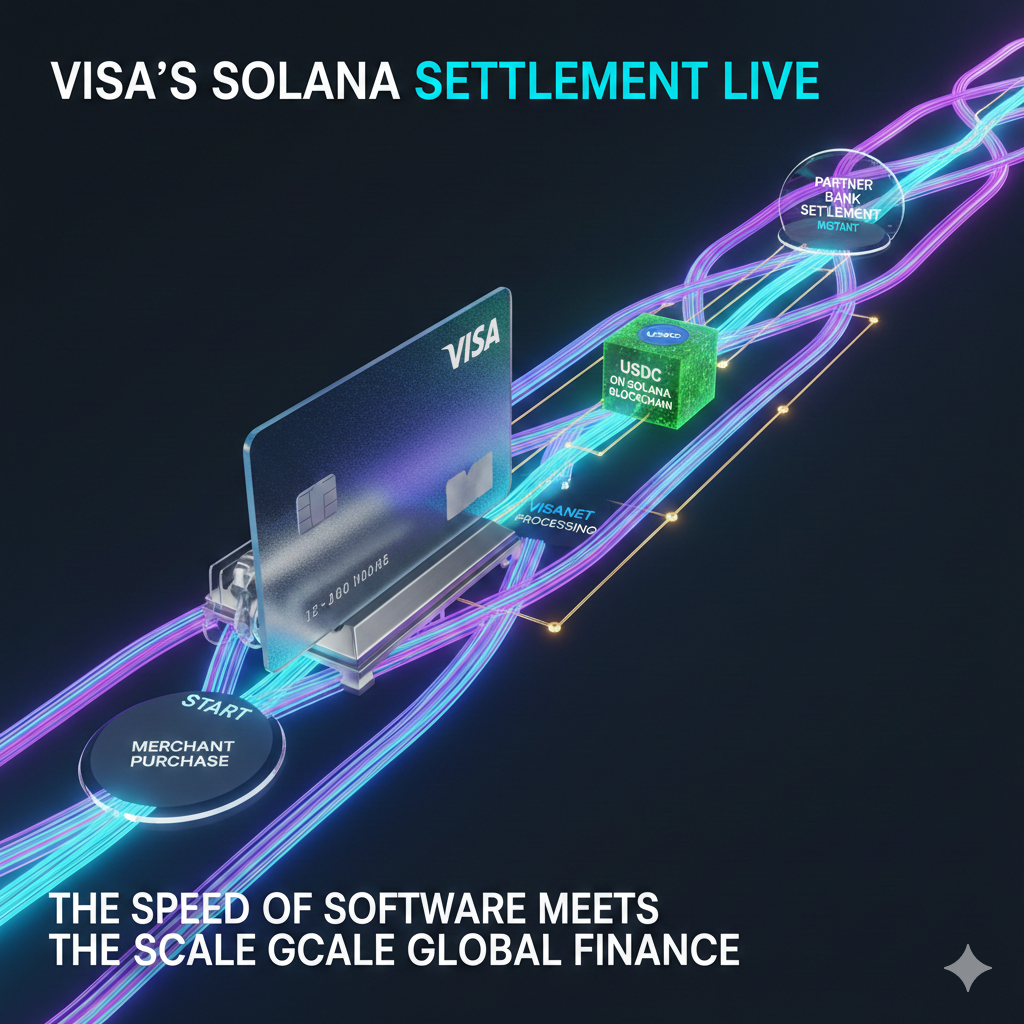

TL;DR: On December 16, 2025, Visa transitioned its USDC settlement operations from experimental pilots to a live production environment on the Solana blockchain. By processing institutional transactions for partners like Cross River Bank, Visa eliminates the 60-hour "weekend liquidity gap," achieves a $3.5 billion annualized run rate, and establishes high-speed public blockchains as the foundation of modern treasury management.

Who This Is For

- Treasury Managers: Professionals seeking to eliminate collateral drag and idle capital during bank holidays.

- Institutional Investors: Entities requiring a high-throughput, bank-grade settlement layer for digital assets.

- Fintech Architects: Developers and executives evaluating Solana’s monolithic architecture against Layer 2 alternatives.

On December 16, 2025, Visa ended the "weekend liquidity gap"—the 60-hour window where global finance traditionally freezes. What began as a 2021 Ethereum pilot has matured into a live production environment. By integrating USDC (USD Coin) settlement into the core infrastructure of U.S. financial institutions, Visa has transformed blockchain from a fintech experiment into a high-velocity, bank-grade settlement layer.

1. The $3.5B Production Milestone

Capital at stake serves as the ultimate metric for blockchain maturity. Visa’s stablecoin settlement volume now maintains a $3.5 billion annualized run rate. This figure validates that public blockchains can facilitate heavy-duty clearing between regulated financial entities at scale.

Cross River Bank and Lead Bank serve as the network’s primary production nodes. These institutions bypass legacy batch processing in favor of Solana’s real-time rails. This migration occurs as the total stablecoin supply reaches $300 billion, supported by monthly on-chain volumes exceeding $1.1 trillion. Visa provides the essential infrastructure to meet these massive liquidity demands.

2. Technical Superiority: The Solana Advantage

Institutional finance demands throughput and finality. While Ethereum serves as a hub for Total Value Locked (TVL), its Layer 2 fragmentation introduces complexity and latency that hinder high-velocity settlement. Visa chose Solana’s monolithic architecture for three specific technical advantages:

- Parallel Execution (Sealevel): Traditional blockchains operate like single-lane toll booths, processing one transaction at a time. Solana’s Sealevel engine acts as a multi-lane superhighway, processing non-overlapping transactions simultaneously. This maintains fees under $0.01 even during peak demand.

- Performance Scalability: Visa requires rails that can match its internal capacity of 65,000+ TPS. In production, Solana demonstrates 2,000+ user-generated TPS with sub-second finality, far exceeding Ethereum’s base layer limit of approximately 12 TPS.

- Reduced Fragmentation: Single-layer execution eliminates the "hop" risks and liquidity fragmentation associated with rollups and bridges.

3. Treasury 2.0: 24/7 Liquidity

Stablecoin settlement replaces the "postal mail" speed of traditional banking with the "instant messaging" speed of software. For merchant acquirers like Worldpay and Nuvei, this shift eliminates collateral drag.

In the legacy system, a Friday night transaction might not settle until Tuesday. Solana’s 24/7/365 rails allow these entities to manage liquidity on weekends and bank holidays. This capability transforms treasury from a reactive cost center into a real-time optimization engine.

"We are finally seeing internet-native money moving at the speed of software. This isn't just a faster payment; it's a fundamental restructuring of how value is stored and moved."

— Nikhil Chandhok, Circle CPTO

Visa abstracts this complexity from the end-user. Consumers continue to use their cards seamlessly, while the treasury layer handles USDC minting and Sealevel execution in the background. The result is faster merchant payouts and reduced overhead costs.

4. Future Roadmap: Arc and MiCA Compliance

Visa’s strategy encompasses a multi-chain future. The company currently acts as a design partner for Arc, Circle’s upcoming Layer 1 blockchain, and will operate a validator node at launch. This suggests a tiered approach: Solana for high-velocity retail settlement, and Arc or Ethereum for specialized regulatory or smart-contract-heavy use cases.

Regulatory clarity from Europe’s MiCA framework and a maturing U.S. legal landscape provided the certainty required for this rollout. Global finance is moving toward Programmable Treasury, where smart contracts automate fund movements based on real-time needs, ensuring capital never sits idle.

Our Verdict

Visa’s transition to a live Solana production environment is the most significant institutional blockchain milestone of 2025. It successfully moves stablecoins from the "alt-finance" periphery to the core of the U.S. banking system. Solana is no longer just a retail platform; it is the new backbone for institutional high-velocity settlement. Financial institutions must now adopt these 24/7 rails or continue to suffer the inefficiencies of legacy systems.

Key Takeaways

- Institutional Standard: Visa has replaced pilots with a $3.5B annualized production environment.

- Immediate Efficiency: 24/7 settlement removes the "weekend liquidity gap" and reduces collateral requirements.

- Architecture Matters: Solana’s parallel processing provides the necessary speed and cost-efficiency that fragmented Layer 2 solutions lack.

- Global Scale: USDC on Solana now serves as a primary money movement layer across 40+ countries.