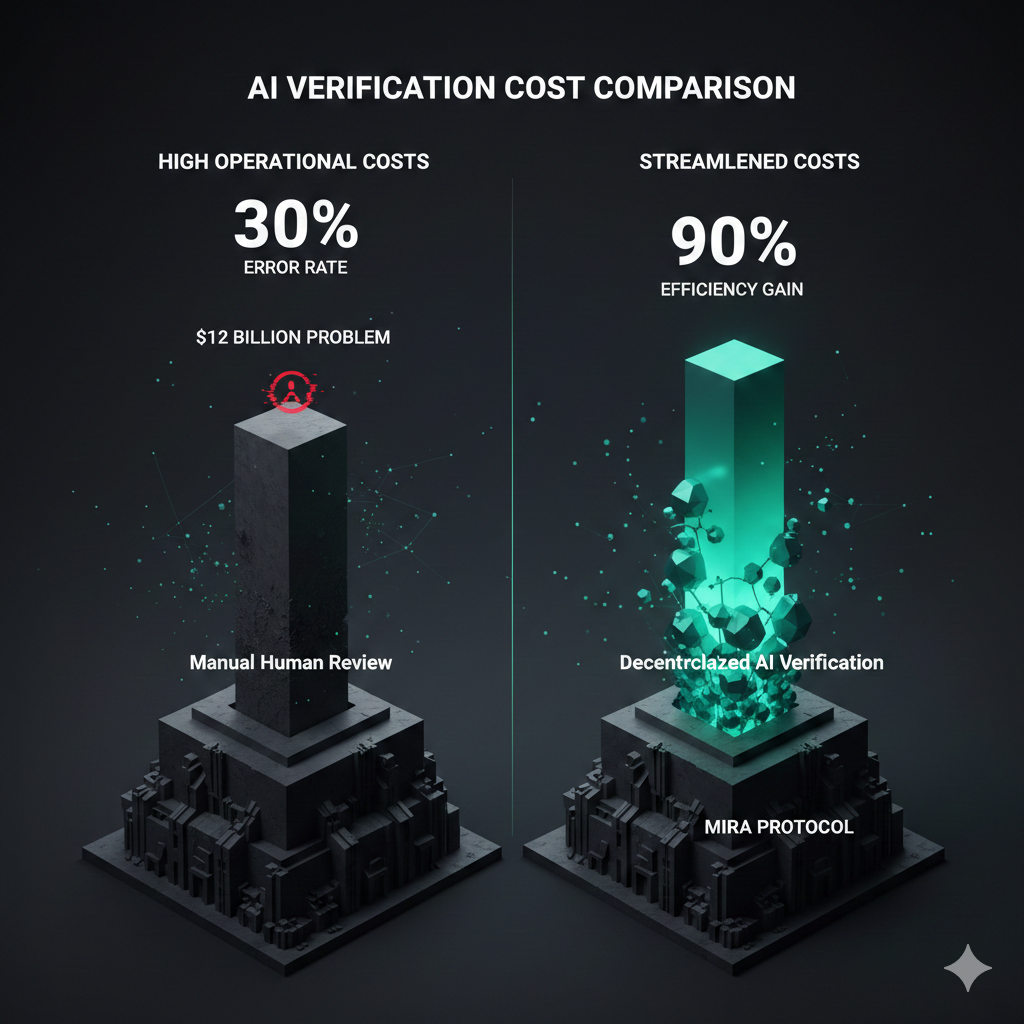

TL;DR: The AI-crypto narrative has transitioned from raw computation to the "Trust Layer." While LLMs struggle with 30% hallucination rates, Mira (MIRA) provides the decentralized infrastructure required to cryptographically verify AI outputs. With the verification sector projected to reach $12 billion by 2026, the industry is shifting toward "Agentic AI"—autonomous systems backed by on-chain proofs of accuracy.

Who This Is For

- Enterprise Decision Makers: Organizations integrating AI into high-stakes workflows (legal, medical, financial) that require zero-margin error rates.

- Institutional Investors: Those seeking exposure to AI infrastructure beyond commoditized GPU power.

- Web3 Architects: Developers building autonomous agents that require trustless, third-party validation to execute on-chain transactions.

The "Confident Lie" prevents the mass adoption of Artificial Intelligence. In high-stakes sectors, a single AI hallucination triggers catastrophic financial loss or safety risks. While 2024 centered on "Compute Wars," 2025 defines the era of Infrastructure Reality. Hardware is a stranded asset if its output remains unverified. The "Trust Layer" solves this by functioning as an immutable truth machine for AI logic.

1. The $12 Billion Problem: Verification as a Fiscal Necessity

Large Language Models (LLMs) maintain an inherent error rate of approximately 30%. This margin is untenable for enterprise-level integration. Manual human review—the historical fallback—creates operational bottlenecks that erase the efficiency gains of AI.

Solving this represents a massive economic opportunity. The Gartner Emerging Tech Trends Report (2024) projects the AI reliability and verification market will exceed $12 billion by 2026. Real-world impact is already evident: tools like the Delphi Oracle have reduced research synthesis costs by 90% by replacing human auditors with decentralized verification workflows.

2. Technical Architecture: How the Trust Layer Operates

Mira innovates through the Binarization of Claims. The system decomposes complex AI output into "atomic claims"—singular, verifiable statements. This process mimics a professional fact-checking department, isolating every sentence and distributing it to specialized expert nodes for validation.

The Hybrid Consensus Model

Mira maintains network integrity through a two-pronged economic and technical approach:

- Meaningful Proof-of-Work (PoW): Mira replaces hollow cryptographic puzzles with "meaningful" tasks. Node energy processes real-world AI inferences, providing tangible utility to the network.

- Proof-of-Stake (PoS) & Slashing: Operators stake MIRA tokens. The network "slashes" (confiscates) the stake of any node that "lazy-loads" results or submits malicious data.

A distributed architecture preserves privacy. No single node accesses the full user prompt or response; they interact only with assigned fragments. This ensures enterprise data remains confidential during public, decentralized verification.

3. Adoption Metrics & Market Performance

As of December 2025, Mira is a dominant infrastructure player. According to Mira’s September 2025 mainnet audit, the network processes 3 billion tokens daily for over 4.5 million users. Most importantly, the decentralized consensus model has reduced AI error rates from the 30% industry average to less than 5%.

Investors must distinguish between the "Compute Layer" and the "Trust Layer." While competitors like Bittensor (TAO) focus on AI generation, Mira focuses on the proof of accuracy. Compute is a commodity; verification is the gatekeeper.

Market Data: Based on CoinGecko records, MIRA holds a market capitalization of approximately $26M with a Fully Diluted Valuation (FDV) of $127.7M. While the Lumira mobile app has accelerated adoption, investors should prepare for high volatility and a mobile user experience currently reliant on advertising.

4. 2026 Roadmap: Transitioning to Agentic AI

The Trust Layer leads directly to Agentic AI—autonomous systems that make independent financial or medical decisions. Before a machine executes a bank transfer or prescribes a dosage, a third party must cryptographically "seal" its logic. This requirement drives Mira’s planned migration to Mirex (MRX) in 2026.

The Mirex migration introduces a dual-token model built for Real-World Asset (RWA) tokenization. By aligning with Swiss FINMA regulatory frameworks, Mira positions itself to capture institutional capital that requires strict compliance and "proof of truth" before deploying capital into AI-driven markets.

Our Verdict

Verification is the primary bottleneck for the AI economy. Without a decentralized mechanism to guarantee accuracy, AI cannot scale to professional-grade applications. Mira has effectively proven that trust-layer protocols can reduce LLM hallucinations to sub-5% levels. In the 2025 market, utility tokens that provide concrete verification services offer more fundamental value than speculative AI assets. The upcoming Mirex migration makes Mira a critical infrastructure play for the 2026 shift toward Agentic AI and RWA tokenization.

Key Takeaways

- Accuracy is Infrastructure: AI requires decentralized verification to achieve enterprise-grade reliability.

- Quantifiable Improvement: Trust-layer protocols have reduced error rates from 30% to under 5%.

- Economic Moat: While compute power is easily replicated, a decentralized network of specialized verification nodes creates a significant barrier to entry.

- Evolution to Autonomy: The 2026 focus on Agentic AI makes cryptographic truth layers a prerequisite for institutional adoption.