TL;DR: The economy moves in a predictable, though not precisely timed, four-stage loop: Expansion, Peak, Contraction (Recession), and Trough (Recovery). To spot the current stage, look for changes in key indicators like GDP growth, the Unemployment Rate, and the Yield Curve. By understanding the characteristics and indicators of each stage, you can proactively adjust your financial and investment strategy, shifting from growth stocks during an Expansion to defensive sectors when a Peak or Contraction is imminent.

🎯 Who This Guide Is For

This guide is for any financially engaged individual—investors, professionals, or business owners—who wants to move beyond simply reacting to market news. It provides the definitive framework for interpreting economic signals and proactively managing financial risk and opportunity.

👋 Spotting the Hidden Structure Behind Market Volatility

Watching the stock market dive prompts the question: "Why now? Is this random?" While the exact timing of market movements often feels chaotic, the overall rhythm of the economy is not. It follows a hidden structure, a continuous loop that dictates everything from job security to mortgage interest rates.

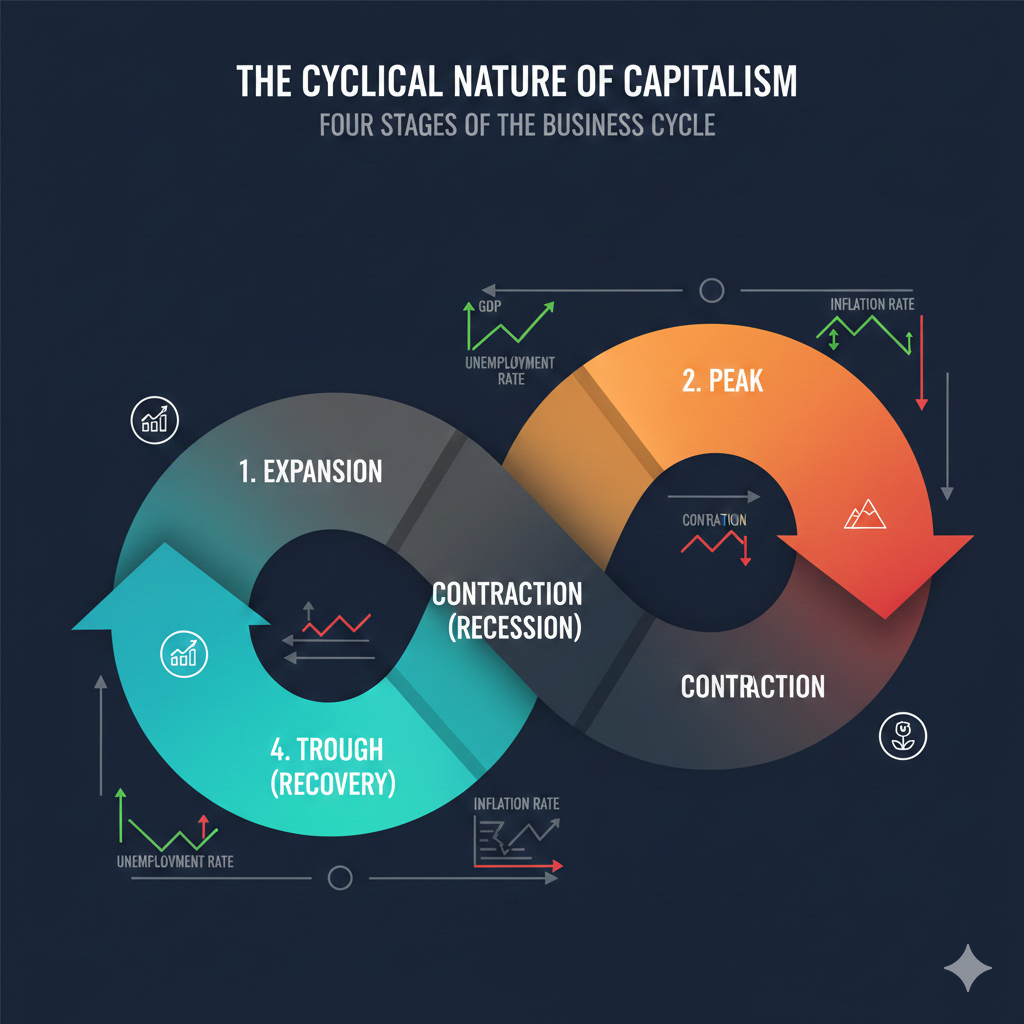

This structure is the business cycle, a recurrent fluctuation in a nation's aggregate economic activity. It is capitalism’s natural heartbeat—an alternating sequence of growth and slowdown that has defined modern economies for centuries. Understanding this cycle is your essential playbook for proactive financial and investment decisions.

We break down the four key stages of the business cycle and, crucially, provide the practical, real-time tools—the economic indicators—you need to spot them. Consider this your developer’s guide to debugging the economy.

📈 The Four Stages: Defining the Business Cycle

The business cycle is a continuous, natural, and necessary process. Think of it like the four seasons: the energy, activity, and appropriate strategy (or investment plan) change with each one, but the cycle never truly ends. These are the four stages:

Stage 1: Expansion (The Boom)

This is the economic summer where the economy thrives.

- Key Characteristics: Gross Domestic Product (GDP) is rising, employment is increasing, wages are going up, and consumer spending is high thanks to optimism and job security. Stock prices generally trend upward.

- Sector Outperformance: Investment shifts towards high-growth, cyclical sectors. Think **Information Technology (IT), Financials, and Consumer Discretionary** (products like new cars, expensive vacations, and non-essential goods).

Stage 2: Peak (The Apex)

The Peak is the turning point before the inevitable shift. The economy runs at full capacity and often shows signs of "overheating."

- Key Characteristics: GDP growth plateaus, and the economy is near full employment. Critically, as demand outstrips supply, inflationary pressures build, often signaling that the central bank must soon intervene.

- Sector Shift: Savvy investors become cautious, shifting toward **"defensive" sectors** that perform well regardless of the cycle, such as Utilities, Healthcare, and Consumer Staples.

Stage 3: Contraction (The Recession)

This is the economic winter, a significant downturn where economic activity slows substantially.

A technical recession is often cited as two consecutive quarters of negative GDP growth.

- Key Characteristics: GDP is declining (or negative), unemployment rises rapidly, consumer and business spending drops, and corporate profits decline. Stock markets typically experience a significant downturn.

- Pain Points: Uncertainty hits hard for the average consumer. Job loss and the fear of job loss become major pain points, leading to financial stress and a focus on saving rather than spending.

Stage 4: Trough/Recovery (The Bottoming Out)

The Trough is the absolute lowest point of the cycle. It represents the transition where the economy stops sinking and stabilizes before the next expansion begins.

- Key Characteristics: Economic indicators "bottom out." Negative GDP growth abates, and activity begins to move upward. Sentiment is often at its worst, but the necessary economic foundation is being laid for the next boom.

- Historical Context: Historically, U.S. contractions (recessions) have been relatively short, averaging about 11 months between 1945 and 2019, while expansions have been much longer, averaging about 65 months.

🛠️ The Investor's Toolkit: Spotting the Turning Points

Spotting the cycle means tracking the correct signals. Experts like the National Bureau of Economic Research (NBER) use a combination of indicators to define the phases. We categorize these indicators as Leading (predictive), Coincident (real-time), and Lagging (confirmatory).

Leading Indicators (The Predictive Signals)

These indicators predict what is coming in the next 3 to 12 months. Pay close attention to these:

- The Yield Curve: This is a powerful signal. A **steep yield curve** (long-term rates much higher than short-term rates) often signals an Early Cycle/Recovery. Conversely, an **inverted yield curve** (short-term rates higher than long-term) has historically been one of the most reliable predictors of an impending Contraction.

- Business Capital Spending: When companies cut back on investments for new equipment, factories, or Research and Development (R&D), it signals an ominous slowdown.

- Inventory Levels: Low business inventories combined with significantly growing sales are a classic sign of early expansion—companies struggle to keep up with demand.

Coincident/Lagging Indicators (Confirming the Stage)

These tell you where the economy is right now or where it has recently been. The most definitive measure is Gross Domestic Product (GDP). Rising GDP signals Expansion, while negative GDP growth for two consecutive quarters is the technical confirmation of a Contraction.

- Employment Rates/Unemployment: This is a key signal. Rising unemployment starkly confirms a Contraction; full employment (low unemployment) signals an approaching Peak.

- Consumer Sentiment (CCI/CSI): High consumer confidence fuels Expansion because people feel secure enough to spend. When confidence plummets, it strongly signals a coming Trough, as consumers prioritize saving.

Inflation and Interest Rates

These two indicators confirm the transition from Expansion to Peak.

- Inflation Rates: Low-to-moderate inflation signals healthy expansion. However, persistently rising inflation as the economy starts to "overheat" can signal that the Peak is near and a slowdown is required.

- Interest Rates: The central bank tends to keep rates low during the initial Expansion. But as the economy approaches the Peak, they typically raise rates to intentionally slow down borrowing and spending, taming inflation and preventing an uncontrolled bust.

🛡️ Navigating the Cycle: Strategy for Consumers and Investors

Just as you wear shorts in the summer and a heavy coat in the winter, your financial strategy must adapt to the economic season.

Actionable Consumer Advice

- During Expansion: While employment is high, use the opportunity to aggressively pay down high-interest debt and build your savings. **Build your financial fortress** during this time. You have the freedom for increased discretionary spending, but do not let it outpace your savings goals.

- During Contraction/Trough: Your priority must be to build or top up your **emergency savings** (6–12 months of expenses). Avoid making major, high-cost discretionary purchases and postpone high-risk investments until the recovery is clearly underway.

Investment Strategy by Phase

Think of your portfolio as needing to "rotate" sectors as the cycle matures:

- Early/Mid-Expansion: Focus on **Growth-Oriented/Cyclical stocks** (e.g., Technology, Consumer Discretionary, Industrials). These sectors thrive when people and businesses are spending freely.

- Peak/Late Cycle: Shift toward **Defensive sectors** (e.g., Utilities, Consumer Staples, Healthcare) and more conservative investments like high-quality bonds. People still pay their utility bills and buy groceries regardless of the economic climate.

🔮 Beyond the Boom-Bust: Forces Shaping Future Cycles

Capitalism has historically shown remarkable resilience, often using a crisis to "reinvent" itself, leading to new technological investment and business models. While the fundamental mechanism of the business cycle is unlikely to disappear, its character is changing.

Future cycles will be shaped by new pressures:

- ESG and Growth Scrutiny: Movements like "degrowth" and the push for a circular economy challenge the traditional consumption-driven model. This may temper the amplitude (height) of future consumption booms, potentially making the Expansion phase less volatile.

- Resilience and Localization: Post-COVID supply chain disruptions caused governments and companies to prioritize economic localization and self-sufficiency. This affects the duration and amplitude of international trade cycles.

- Technological Impact: Advanced technologies like Big Data and generative AI are already impacting our ability to forecast and simulate future economic scenarios. While they can improve forecasting, political and human behavioral factors will always remain the key unpredictable variables.

✅ Our Verdict

- The business cycle is a predictable sequence of four phases: Expansion, Peak, Contraction, and Trough.

- The cycle is most reliably spotted by tracking leading indicators (like the Yield Curve and Capital Spending) and confirming with coincident indicators (like GDP and Unemployment).

- Your financial strategy must be cyclically aware. Shift from growth stocks/debt reduction during an Expansion to defensive stocks/emergency savings during a Contraction.

- While external forces (ESG, localization, technology) change the cycle's dynamics, the rhythm of boom and bust remains the fundamental language of the capitalist economy.

Start tracking a personal "Business Cycle Dashboard" today using GDP, the Unemployment Rate, and Consumer Confidence. Having this map is the first step toward proactive financial security.