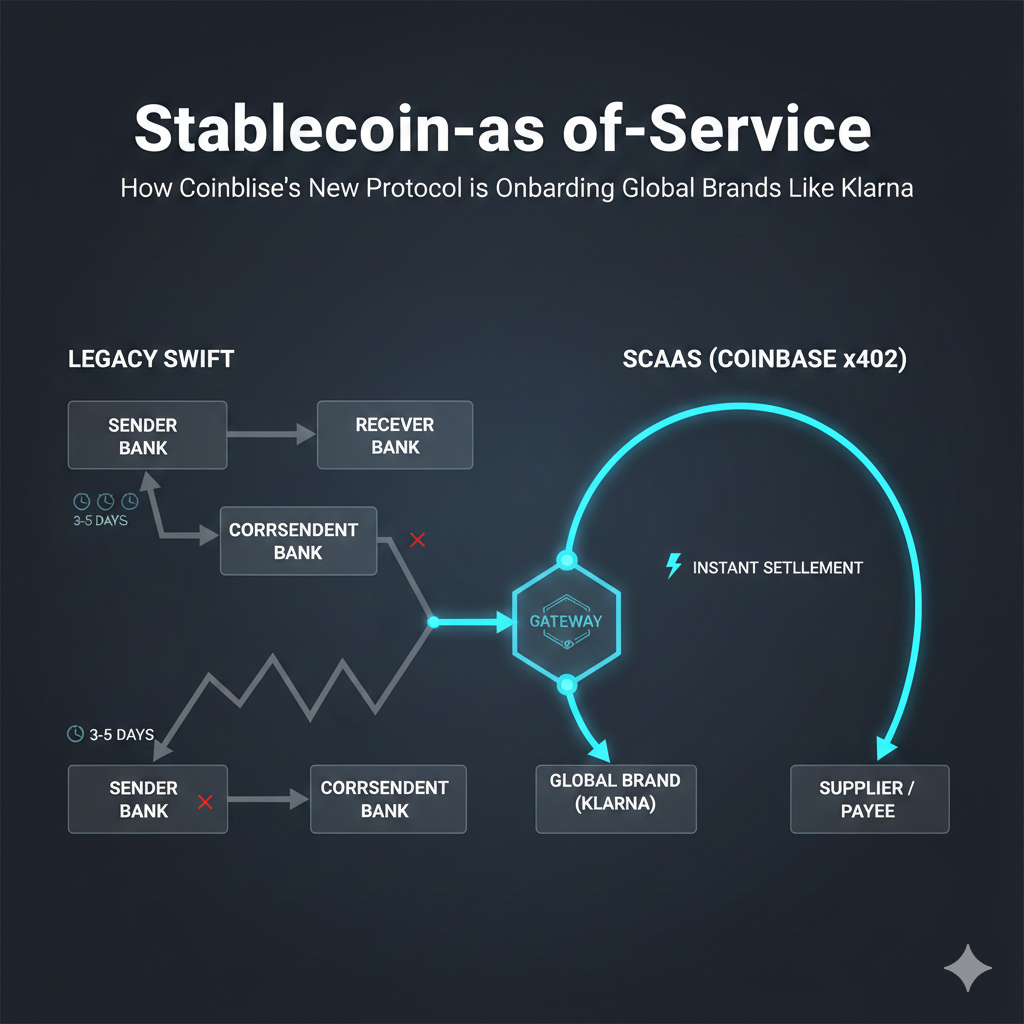

TL;DR: Global finance is migrating from speculative assets to Stablecoin-as-a-Service (SCaaS). By adopting Coinbase’s x402 protocol, enterprises like Klarna are replacing legacy 144-hour settlement delays with 400-millisecond block times and 24/7 liquidity.

Our Verdict

Stablecoin-as-a-Service is the definitive infrastructure for modern corporate treasury. Coinbase’s stack transforms currency from a passive medium into a programmable utility, making traditional SWIFT-based banking obsolete for high-velocity global brands. This is no longer a crypto experiment; it is the new standard for financial hardware.

Who This Is For

- CTOs and Financial Architects seeking to eliminate intermediary fees and settlement latency.

- Corporate Treasurers requiring 24/7 liquidity and programmable revenue distribution.

- Fintech Developers building autonomous AI agents that require machine-to-machine payment protocols.

The SCaaS Evolution: Financial Infrastructure as a Service

Moving money across borders via the SWIFT network is a relic of the pre-internet era. With annual stablecoin transaction volumes reaching between $5.5 trillion and $27 trillion, the market has pivoted from static holding to high-velocity utility. Stablecoin-as-a-Service (SCaaS) provides enterprises the same elasticity AWS brought to computing.

Coinbase currently powers over 260 global businesses, allowing them to bypass server-rack equivalent banking systems in favor of cloud-native financial rails. In Southeast Asia, 43% of B2B cross-border payments already utilize these stablecoin rails. This is a permanent migration to superior financial hardware.

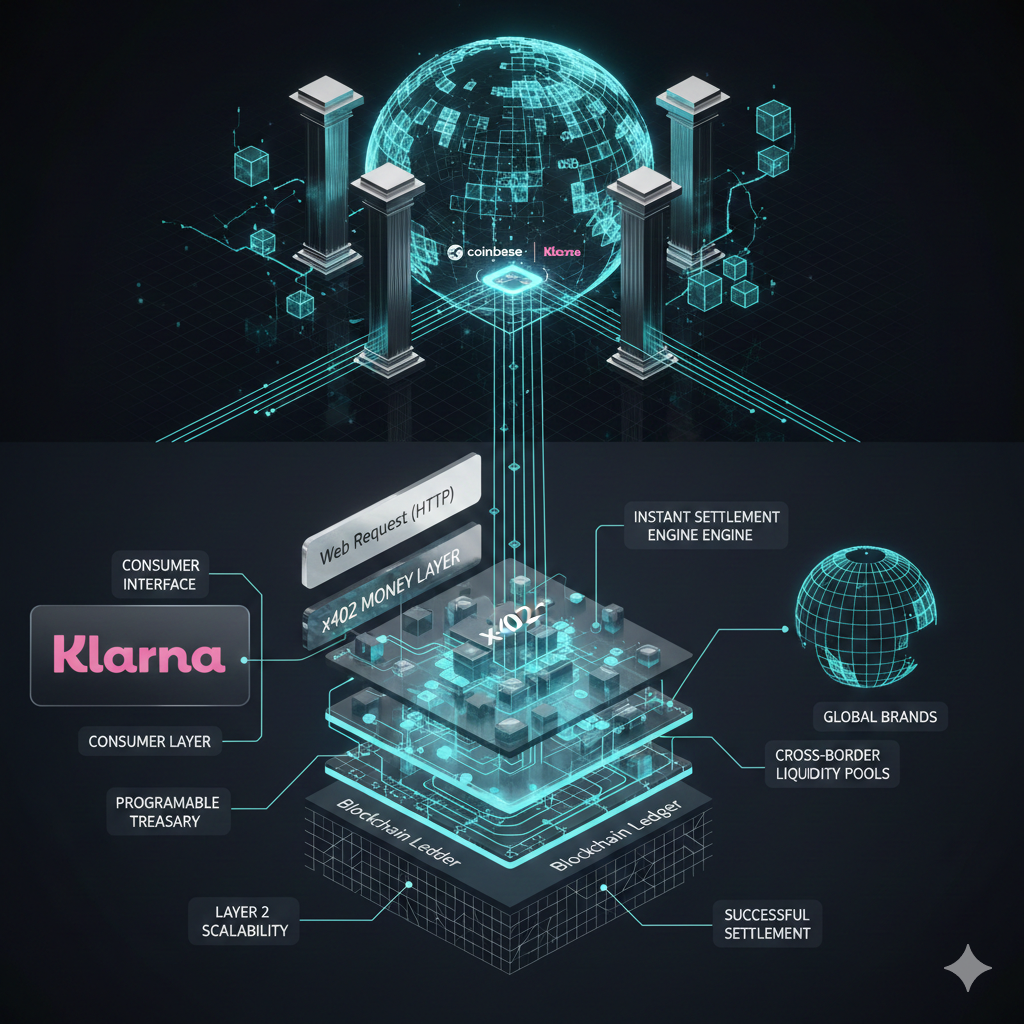

Technical Architecture: x402 and Programmable Money

The x402 protocol functions as the "HTTP of Money," binding payments directly to web requests. This standard enables Agentic Commerce, where autonomous AI agents execute micro-transactions without human intervention or credit card surcharges. Coinbase’s infrastructure allows brands to issue custom tokens backed by interest-bearing U.S. Treasuries, creating "Smart Money" that generates yield during transit.

Tech Insight: Programmable Treasury

Embedded business logic automates revenue distribution. Systems can now autonomously route 20% of incoming funds to tax reserves and 10% to sustainability funds the moment a transaction hits the ledger, eliminating manual reconciliation.

Case Study: Klarna’s Liquidity Strategy

Klarna utilizes SCaaS to achieve "grid redundancy" for its capital. While traditional banks throttle liquidity during weekends and holidays, Klarna accesses short-term funding via USDC 24/7. By exploring the Tempo blockchain and Open Issuance platform, Klarna maintains a multi-cloud financial strategy that prevents vendor lock-in and ensures total systemic resilience.

Consumer Impact: Efficiency as a Feature

SCaaS adoption removes the 3% merchant fee tax. Brands can redirect these savings into consumer value or ESG initiatives. The shift produces three primary benefits:

- Global Stability: Users in volatile markets gain immediate access to USD-pegged assets through local apps.

- Frictionless Retail: Integration allows users to fund "Pay Later" purchases directly from stablecoin balances.

- Institutional Yields: Branded stablecoins allow fintechs to pass institutional-grade APY from treasury reserves down to retail users.

The Future: The Everything Exchange

The 2025 GENIUS Act provides the regulatory certainty necessary for mass institutional adoption. Stablecoins will reach $2.8 trillion in circulation by 2028. We are entering the era of the "Everything Exchange," where every brand operates as its own micro-central bank, managing loyalty and liquidity through interoperable digital assets. For financial leaders, ignoring SCaaS is a "Kodak moment" in a world where value finally moves at the speed of information.

Key Takeaways

- SCaaS is the new infrastructure standard: Enterprise finance now follows the SaaS model for rapid, compliant deployment.

- x402 enables the AI economy: The protocol bridges the gap between web requests and instant value transfer.

- Liquidity is constant: Stablecoin rails eliminate the 3–5 day settlement cycle, providing 24/7/365 treasury agility.

- Systemic Efficiency: Reducing intermediary friction creates a more resilient and sustainable global economic system.