⚡️ TL;DR: Solana's Validator Shift

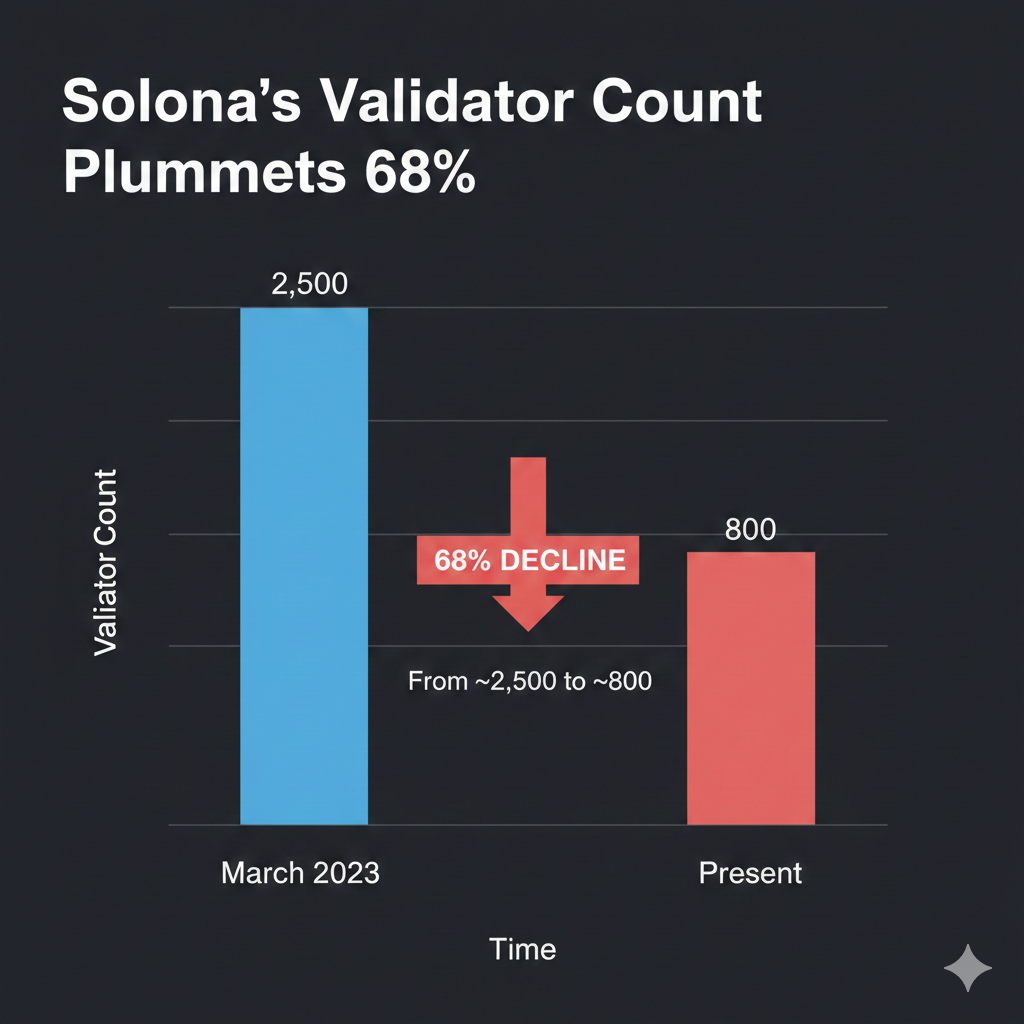

Solana’s active validator count plummeted 68% (from ∼2,500 to ∼800) since March 2023. This is an immediate market consolidation event driven by high hardware costs and low staking rewards (∼4.23% APY) that fail to cover operational expenses for smaller operators. While the raw count decline raises decentralization questions, network security remains stable. A high ∼67.18% staking ratio and Solana’s stake-weighted consensus model mitigate immediate threat. Future strategic upgrades like Firedancer and Alpenglow will boost resilience and client diversity, ensuring long-term economic sustainability.

Who This Is For

This analysis is for SOL holders and institutional investors seeking to understand the underlying infrastructure security of the Solana network, the economics of staking, and the impact of the validator consolidation trend on the network’s long-term viability.

The Validator Exodus: Magnitude and Economic Drivers

The Solana network has fundamentally reshaped its decentralized infrastructure, an unusual trend across major blockchains. The number of active validators on Solana shrank dramatically, experiencing a ∼68% decline from its March 2023 peak of ∼2,500 nodes down to ∼800 currently. This contraction is not merely a statistical anomaly; it signals a fundamental shift in the economic viability of operating a high-performance node on the network.

Market analysts describe this trend as **Consolidation**, a necessary phase where sub-scale operators, unable to sustain high costs, ceased independent validation. These operators delegate their stake to larger, professional entities instead. A severe economic barrier to entry caused this exodus.

The Economic Barrier

Running a Solana validator demands substantial initial capital and an ongoing operational commitment. Initial setup costs for enterprise-grade hardware range from $\sim \$2,500$ to over $\sim \$5,000$. Continuous operational expenses for hosting, bandwidth, and maintenance are significant, ranging from $\sim \$100$ to over $\sim \$1,500$ per month.

The estimated Annual Percentage Yield (APY) for staking sits at approximately $\sim 4.23\%$. For many smaller, independent operators, rewards consistently fail to cover the high fixed and variable costs, especially during periods of lower network activity. This financial imbalance renders the venture economically unsustainable for many.

The Solana Foundation's Decisive Action

A strategic decision by the Solana Foundation accelerated the speed of this contraction. The Foundation reduced its extensive SOL token delegation and loan programs to decrease its outsized influence and promote genuine, decentralized participation. While this is a critical goal for long-term network health, the action immediately removed the subsidies that financially supported marginal validators, hastening their exit.

Security Nuance: Technical Demands vs. Stake Weight

The High-Performance Tax: Technical Requirements

Solana’s architecture, which combines **Proof of Stake (PoS)** with its unique **Proof of History (PoH)** mechanism and **Tower BFT** consensus, engineers unparalleled throughput. This high-speed performance, however, requires resource-intensive hardware, creating a demanding technical prerequisite that filters out all but the most committed operators:

- **CPU:** High-end models with $24+$ physical cores and a $3.9+$ GHz base clock.

- **RAM:** $384$GB DDR5 ECC Registered or more.

- **Storage:** Multiple terabytes of enterprise-grade NVMe SSDs.

These highly specific hardware requirements, according to technical guides, effectively filter out hobbyist and independent operators, directly driving the observed consolidation.

True Metrics of Security

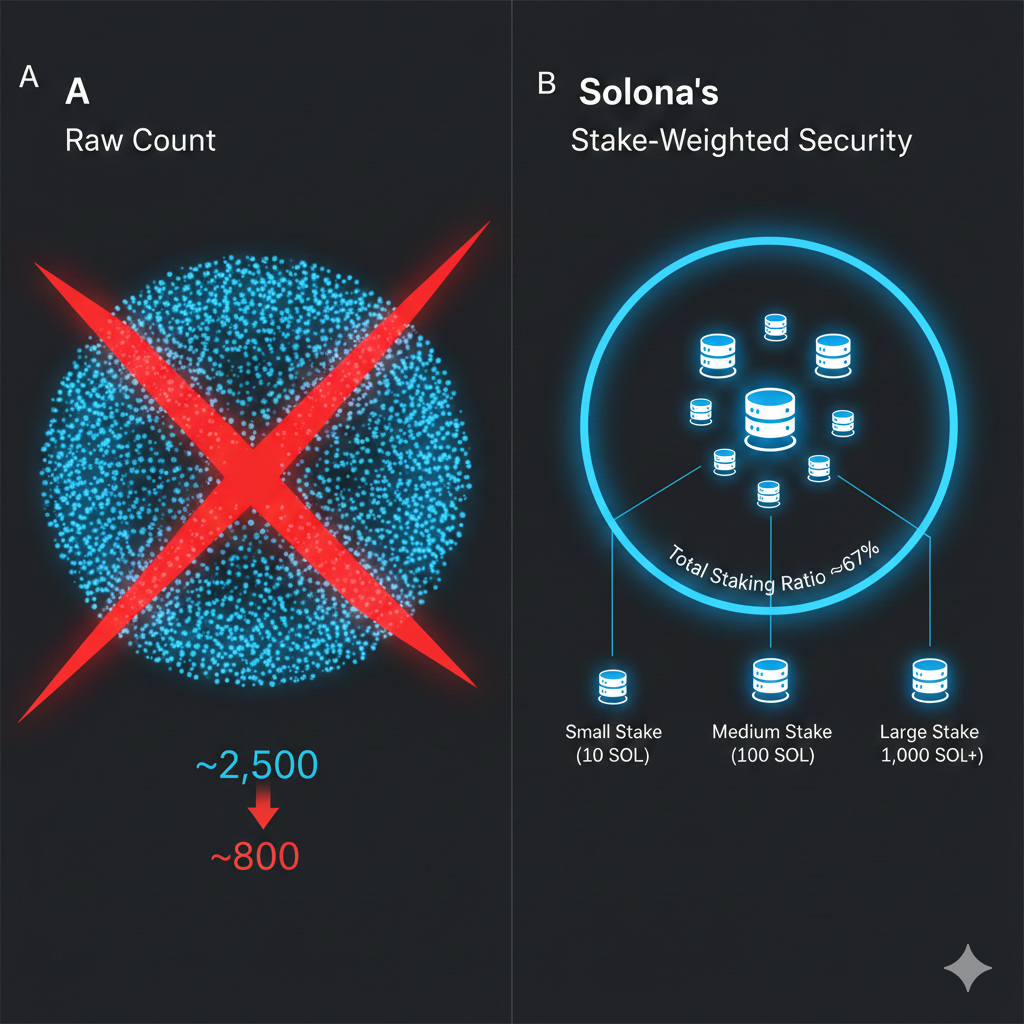

While the $\sim 68\%$ drop in the raw validator count concerns the market, the network's foundational design mitigates any immediate threat to security. **Security is stake-weighted, not count-weighted.**

- **Robust Staking Ratio:** The network maintains a robust **Staking Ratio**, with approximately $\sim 67.18\%$ of the total SOL supply currently staked. Since validator votes are weighted by the amount of staked SOL delegated to them, this high ratio acts as a core security stabilizer against a $51\%$ attack.

- **Quality Over Quantity:** Experts view the decline as a positive “cleansing” of low-quality, inefficient, or potentially malicious nodes. Remaining, larger operations are generally more professional, reliable, and equipped to maintain uptime, which improves overall network reliability.

Reliability vs. Stability

User and institutional sentiment remains cautious due to Solana's history of past reliability concerns, including a notable $\sim 18$-hour outage. Although the network operates reliably as of late 2025, the demand for constant, institutional-grade uptime—particularly for tokenized financial assets—makes reliability paramount. The consolidation toward high-quality operators inadvertently addresses this pain point by professionalizing the validation infrastructure.

Roadmap for Enhanced Decentralization and Resilience

The Solana community and developers actively counter this shift; the network roadmap focuses on strategic technological upgrades that address resilience and economic sustainability directly.

Firedancer: The Critical Client Diversity Upgrade

Introducing **client diversity** is the single most critical element for enhancing long-term decentralization and addressing current risks. Reliance on a single core client implementation presents a single point of failure (a software bug in the main client could take down the entire network). **Firedancer**, a new, independent validator client developed by Jump Crypto, directly mitigates this risk.

- **Purpose:** Firedancer provides an entirely separate code base for validating transactions, fundamentally boosting network resilience.

- **Performance Goal:** It will support a massive increase in throughput, engineered to potentially handle over a million Transactions Per Second (TPS).

- **Decentralization Impact:** Its adoption is crucial for fostering a truly decentralized environment by reducing the dependence on the primary client and encouraging new infrastructure operators.

Consensus and Latency Optimizations

Further technical improvements target core operational efficiency:

- **Alpenglow:** This planned upgrade redesigns the consensus mechanism, utilizing a lightweight voting protocol called **Votor**. The goal is a radical latency reduction to the millisecond range, achieving faster finality and a significant increase in transaction capacity.

- **Future Technologies (ACE & DoubleZero):** These elements are on the 2025-2027 roadmap, focusing on optimizing execution and stability. Their objective is to ensure the network reliably serves global financial markets with extremely low latency and maximum throughput.

Outlook for Staking Viability

For the average SOL holder, staking remains highly accessible, requiring no minimum SOL amount to delegate. This access benefits retail participation. However, delegators rely more than ever on the quality and performance of their chosen professional validator. The network must improve tooling and ultimately reduce node operating costs; this is the only viable path to fostering broader, more diverse validator participation in the future.

Our Verdict

- Economic Consolidation: The ∼68% validator count drop is an economic phenomenon. Unsustainable operational costs and a low ∼4.23% APY, relative to high-performance hardware demands, forced smaller operators out.

- Security is Stable (For Now): Network security remains mitigated by the high ∼67.18% Staking Ratio and the stake-weighted consensus model. The focus successfully shifted from raw node count to the quality and reliability of the remaining professional operators.

- The Technical Solution: The success of the Firedancer client deployment is paramount. It must provide the necessary client diversity to reduce single-point-of-failure risk. This is the essential step toward a resilient, decentralized future for Solana.

The Firedancer and Alpenglow upgrades will be the true test of whether Solana can maintain its promised high throughput while simultaneously cultivating an economically sustainable and diverse validator set. Experienced investors must track the deployment metrics of these key technical milestones and carefully research the performance of their delegated validator.