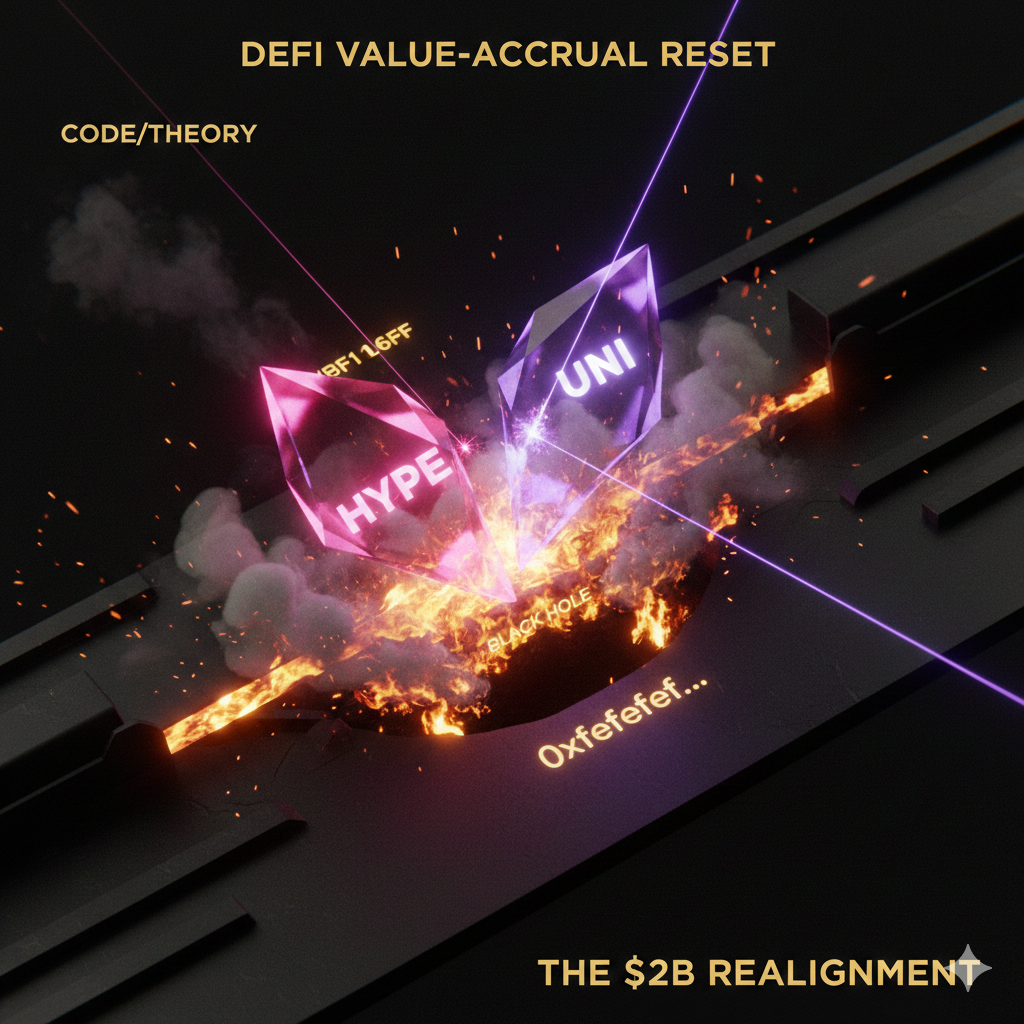

TL;DR: DeFi is executing a $2 billion structural reset. Hyperliquid’s $1 billion HYPE "social burn" and Uniswap’s "UNIfication" fee switch signal the end of governance-only tokens. Protocols are now pivoting toward institutional-grade value-accrual models to ensure long-term sustainability.

Who This Is For

This analysis serves institutional investors, DeFi protocol architects, and active treasury managers who must navigate the shift from inflationary "bootstrap" tokenomics to cash-flow-linked valuation models.

The decentralized finance (DeFi) sector is undergoing a definitive structural realignment. Approximately $2 billion in capital—comprising $1 billion in HYPE and $950 million in UNI—will vanish from circulating supplies by year-end 2025. This move ends the era of "governance-only" chips and establishes a new standard for protocol value capture.

Throughout 2025, revenue-generating protocols like Aave and Jito outperformed legacy assets burdened by inflationary farming. Hyperliquid and Uniswap are now responding to market fatigue by prioritizing institutional scarcity over speculative governance.

I. Hyperliquid: The $1 Billion Social Burn

Hyperliquid dominates the perpetual DEX market, generating $874 million in year-to-date fees. To protect this market position and address recent price pressure, the foundation is executing a "Social Burn" of 37 million HYPE tokens—13% of the total supply.

The Mechanism: Verifiable Scarcity

Hyperliquid bypasses traditional "dead address" burns. Instead, the protocol utilizes a system address (0xfefefef...) that lacks a private key. The December 24 governance vote legally binds validators to reject any future upgrades that could reallocate these funds. This social consensus removes institutional ambiguity, aligning HYPE’s supply with its organic trading volume.

II. Uniswap’s UNIfication: Activating the Fee Switch

Uniswap is moving beyond its $4 trillion lifetime volume to finalize its "UNIfication" protocol. This plan destroys 100 million UNI from the treasury and activates the "fee switch" for v2 and v3 pools, fundamentally altering the DEX's revenue distribution.

Technical Execution: The Token Jar

The "Token Jar" smart contract serves as the engine for this transition. Following the December 25 vote, a two-day timelock precedes the manual burn and the diversion of 1/6th of swap fees into the jar. Analysts project this mechanism will burn between $130 million and $460 million in UNI annually.

| Stakeholder | Pre-UNIfication | Post-UNIfication (Proposed) |

|---|---|---|

| Liquidity Providers (LPs) | 100% of collected fees | ~83.3% (5/6th) of collected fees |

| Protocol Burn (UNI Holders) | 0% | ~16.7% (1/6th) of collected fees |

| End User (Trader) | No change in cost | No change in cost |

Source: Uniswap Foundation Governance Proposal, Dec 2025.

"While some liquidity providers fear yield dilution, a deflationary UNI token and a legally robust ecosystem provide superior long-term returns compared to the current governance-only model."

III. The DUNA Wrapper: Institutional Readiness

The DUNA (Decentralized Unincorporated Nonprofit Association) legal wrapper provides the most significant upgrade for Uniswap. This structure allows the DAO to operate as a legal entity, mitigating tax and liability risks for participants. This framework provides the regulatory clarity institutional investors require before committing capital.

Cantor Fitzgerald analysts note that these transparent accounting practices allow investors to value DeFi tokens using standard Discounted Cash Flow (DCF) models. By bridging the gap between crypto-native mechanics and traditional finance, Uniswap is setting the industry blueprint.

IV. The Competitive Ripple Effect

The success of these initiatives will trigger a "Burn Era." If HYPE and UNI achieve sustained valuation growth, competing protocols like Arbitrum and Optimism must implement similar revenue-share or fee-to-burn models to attract institutional capital. DeFi is transitioning from "Bootstrap Mode" (inflationary incentives) to "Maturity Mode" (tangible value accrual).

Our Verdict

The $2 billion burn marks the most significant evolution in DeFi tokenomics since the "DeFi Summer" of 2020. By converting governance tokens into deflationary, revenue-linked assets, Hyperliquid and Uniswap are professionalizing the sector. These protocols are now the benchmark for institutional DeFi. Investors should watch for the UNI fee switch activation between December 27 and 28 as the primary catalyst for market-wide repricing.

Key Takeaways

- Deflationary Pressure: $2B in combined value is being permanently removed from circulation.

- Cash Flow Dominance: The market is abandoning "governance-only" tokens for revenue-linked models.

- Legal De-risking: The DUNA wrapper enables DAOs to manage revenue without compromising participant safety.

- Valuation Shift: Transparent supply metrics allow for TradFi-style DCF modeling.

- Imminent Deadlines: The technical execution of the UNI burn occurs Dec 27–28.

Would you like a detailed comparison table of the specific tokenomics changes for both protocols?