TL;DR: The Core Assessment

The Debt-to-GDP ratio is the essential metric for assessing a nation's ability to service its total government debt using its economic output (GDP). As global public debt nears 93% of global GDP (IMF data), this understanding is critical. High debt levels, exemplified by the US at 125% or Japan at 230%, create three major financial risks:

- Reduced Fiscal Space: Limits government's capacity for crisis response.

- Higher Interest Costs: Crowds out public services like education and infrastructure.

- Increased Private Borrowing Costs: Slows private sector investment (crowding out).

While debt finances productive investment, current demographic trends and rising structural costs signal an unsustainable fiscal trajectory for many advanced economies. Policy reforms and strict fiscal rules must govern debt management.

Who This Is For

This essential guide is for investors, business leaders, policy analysts, and any citizen seeking an authoritative, non-political framework for judging a nation's long-term financial stability.

Introduction

Global public debt has risen to nearly 93% of global GDP, a compelling and concerning statistic from the International Monetary Fund (IMF). This figure represents trillions in government liabilities. Its true meaning for a nation's economic strength and, more directly, for your long-term financial stability lies in one indicator: the Debt-to-GDP ratio.

We regard this ratio as the ultimate metric for judging a nation's financial leverage and capacity for long-term debt sustainability. This analysis will explain the ratio’s calculation, dissect its true meaning, examine current global trends, and clarify its direct, practical impact on citizens’ lives.

Understanding the Debt-to-GDP Ratio

Definition and Calculation

The Debt-to-GDP ratio is a fundamental macroeconomic metric that quantitatively assesses a country’s total government debt relative to its overall economic productivity. Divide a country's total (cumulative) government debt by its Gross Domestic Product (GDP) for a given period, expressing the result as a percentage. This provides a standardized, size-independent measure of the national debt burden.

$$\text{Debt-to-GDP} = \frac{\text{Total Debt of Country}}{\text{Total GDP of Country}} \times 100\%$$Total debt represents the sum of all outstanding government financial obligations; GDP represents the total monetary value of all finished goods and services produced within a country's borders in a specific time period.

Interpretation: What the Number Means

The ratio fundamentally measures a nation's financial leverage and, critically, its capacity to meet debt obligations through economic activity. A lower ratio signals a more financially stable economy, indicating a greater ability to absorb financial shocks and a higher credit rating.

Conceptually, the ratio represents the number of years required to repay the country's debt if the entire nominal GDP were dedicated solely to repayment—a powerful analogy for the debt burden.

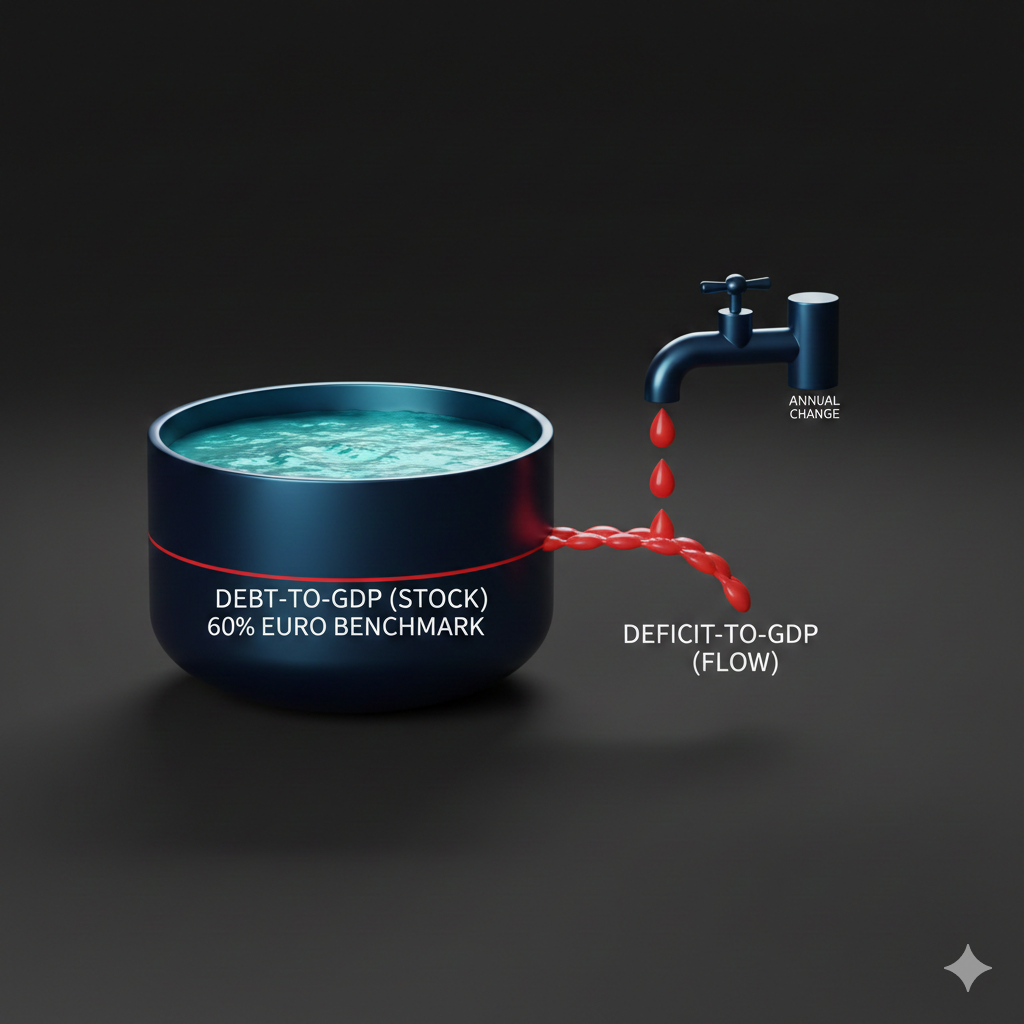

The Debt-to-GDP ratio is a cumulative stock, representing all outstanding government financial obligations.

The Deficit-to-GDP ratio is an annual flow, measuring the yearly net fiscal loss (government spending minus revenue) as a percentage of GDP. This flow adds to the total debt stock.

Global Snapshot: Current Trends and Benchmarks

Key Global Statistics

The post-COVID era cemented high debt levels globally. Total global debt (public plus private) stabilized at just over 235% of global GDP in 2024, significantly exceeding pre-pandemic levels (IMF). The critical concern remains the rise of public debt to nearly 93% of global GDP.

Debt dynamics show a stark regional contrast. Advanced Economies (AEs) saw a slight decline in total debt (from 270% to 267% of GDP), driven by falling private sector liabilities. In contrast, Emerging Markets and Developing Economies (EMDEs) experienced a rise in total debt (nearly 5 percentage points of GDP), fueled by rising private and public borrowing.

Major Economy Comparisons (Case Studies)

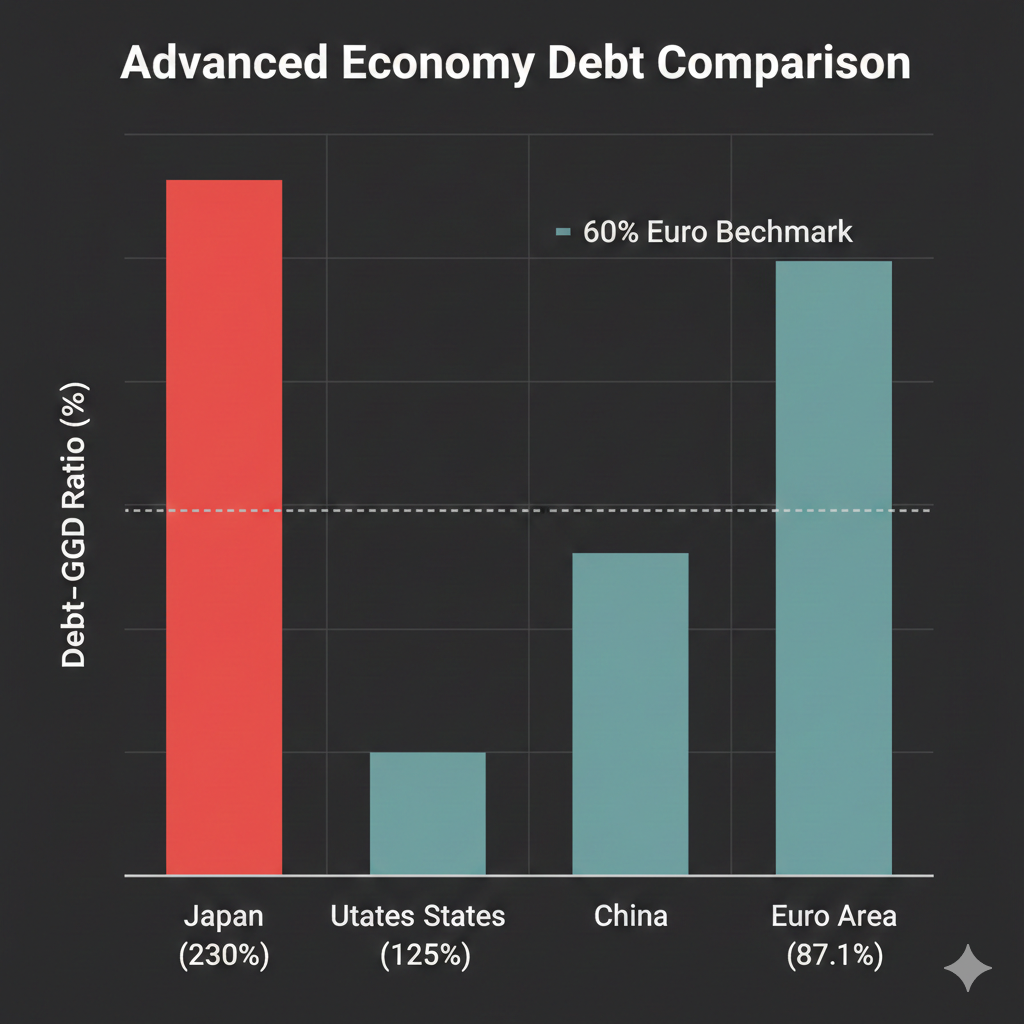

Examining major economies provides necessary context for these global figures:

- Japan: Holds the highest ratio globally, projected at approximately 230% (General Government Gross Debt), reflecting a unique fiscal structure and demographic challenge.

- United States: Ranks highly with a debt-to-GDP ratio of around 125%, a figure projected to continue its upward trajectory due to structural deficits.

- China: General government debt reached 88% of GDP in 2024, up from 82%, reflecting significant post-pandemic stimulus and local government borrowing.

- Euro Area: The government debt-to-GDP ratio stood at 87.1% at the end of 2024 (Eurostat data), indicating high but varied burdens across member states.

The "Tipping Point" Debate and Benchmarks

The search for a “magic threshold” in public debt remains a major point of debate among economists. Older studies suggested a uniform tipping point of 90% public debt to GDP for advanced economies, claiming long-term economic growth rates declined significantly beyond this level. However, subsequent, more rigorous analysis has largely refuted the existence of a single, uniform threshold where growth necessarily slows sharply.

Nevertheless, policy benchmarks remain critical for maintaining fiscal discipline:

- Euro Convergence Criteria: Requires a Government debt-to-GDP ratio below 60% for countries seeking Eurozone membership.

- Sustainability Goal: Policymakers advocate for a long-term sustainability goal of approximately 70% debt-to-GDP for advanced economies, recognizing this as a stable and prudent level.

The Real-World Impact: High Debt on Citizens and the Economy

A high Debt-to-GDP ratio is not merely an accounting problem; it directly translates into tangible costs and limitations for economic growth and public welfare.

The Costs of High Debt (Pain Points)

- Reduced Fiscal Space: High debt severely limits a government's ability to maneuver during an inevitable crisis, such as a deep recession or pandemic. An elevated ratio restricts the capacity for new stimulus spending, tax cuts, or emergency aid, making the economy less resilient.

- Increased Interest Costs (Crowding Out Public Services): As total debt grows, the portion of the national budget allocated to net interest payments rises, especially in a rising interest rate environment. This explicit, unavoidable cost crowds out crucial discretionary spending. In the United States, for example, net interest spending surpassed spending on both defense and Medicare in Fiscal Year 2024 (U.S. GAO data). The government directly diverts funds from public services like infrastructure, education, and healthcare.

- Higher Private Sector Borrowing Costs (Crowding Out Private Investment): Heavy government borrowing increases demand for credit, driving up the baseline interest rate. This phenomenon crowds out private investment by making it more expensive for businesses to borrow for expansion or for individuals to secure loans (e.g., mortgages or car loans), thus slowing private sector growth.

The Benefits of Debt (Context)

Debt is not inherently negative. In a managed context, it serves as a necessary economic tool:

- Productive Investment Funding: Debt that finances growth-enhancing investments—such as cutting-edge research, critical infrastructure projects, or enhanced education and technology—generates future economic returns. These returns ultimately pay for the debt, benefiting future generations with a larger economy.

- Crisis Response: Increased government borrowing is necessary in times of emergency (recessions, pandemics) to stabilize the economy, support citizens, and prevent deeper long-term damage. This temporary spike in the ratio represents a beneficial and justifiable application of fiscal policy.

Future Outlook and Policy Focus

Unsustainable Trajectories

The current fiscal path is unsustainable for many advanced economies. Projections for the United States, under current policy assumptions, indicate the federal debt-to-GDP ratio could reach 200% by 2047 and potentially 535% by 2099 (U.S. GAO). Two structural pressures heavily exacerbate this trajectory:

- Demographic Pressures: The aging population in most advanced economies, combined with rising healthcare costs, continually puts upward pressure on mandatory spending for entitlement programs like Social Security and Medicare. These commitments drive persistent, structural deficits.

- Global Shocks: The increasing frequency of shared global challenges—from financial crises to climate change—will require robust government fiscal flexibility, which elevated debt levels severely strain.

Innovations in Fiscal Management

Addressing these challenges requires technical and structural policy reform, transcending short-term political cycles:

- Fiscal Rules and Targets: Implementing well-designed, independent fiscal rules that include a specific, measurable, and enforceable debt-to-GDP goal is paramount to proactively manage debt growth.

- Budgetary Reform: Fundamental reforms to the national budget process must restore confidence and force structural decisions on both spending and taxation to match long-term obligations with resources.

- Alternative Metrics: Some jurisdictions consider alternative debt metrics, such as the debt-to-GNI (Gross National Income) ratio, in fiscal rules to provide a more accurate picture of debt sustainability relative to national income flows.

Our Verdict: The Indispensable Metric

The Debt-to-GDP ratio remains the indispensable metric for any rigorous assessment of national financial health. It moves beyond absolute dollar figures to measure a country's debt burden against its capacity to service that debt through its economic output.

- The ratio measures the stock of debt, distinct from the deficit (the annual flow).

- High ratios, such as those in Japan (230%) and the US (125%), pose the triple threat of limited fiscal space, increased interest costs that divert spending, and potential "crowding out" of private investment.

- While debt serves as a necessary tool for productive investment and crisis response, current demographic trends and structural deficits suggest that many advanced economies operate on an unsustainable fiscal path. This necessitates urgent policy reform and strict fiscal management.

Understanding this ratio empowers citizens, investors, and policymakers to engage in an informed dialogue about the long-term trade-offs inherent in national spending and taxation. Would you like me to research the current Deficit-to-GDP ratio projections for the United States?