TL;DR: The Core Value

The CFTC launched a three-month pilot program authorizing Futures Commission Merchants (FCMs) to accept Bitcoin (BTC), Ethereum (ETH), and USDC as margin collateral for derivatives. This change eliminates a major institutional roadblock by allowing firms to deploy capital more efficiently, utilizing existing crypto holdings instead of liquidating them for low-yield cash. The program enforces stringent risk management—specifically conservative 'haircuts' to account for volatility—while introducing continuous 24/7 settlement. This regulatory clarity is predicted to shift significant crypto derivatives volume from offshore platforms to U.S. regulated markets, multiplying institutional participation.

🎯 Who This Is For

This information is essential for Institutional Derivatives Traders, Futures Commission Merchants (FCMs), Chief Risk Officers (CROs), and FinTech Developers building compliance and settlement systems for U.S. financial markets. It details a fundamental shift in acceptable collateral and required risk management protocols for digital assets.

💰 Introduction: The Collateral Mandate

The challenge has been bridging the $23 trillion global crypto derivatives market with the rigorous regulatory framework of the United States. While the U.S. market commands a massive portion of the $700 trillion global derivatives pie, it has historically ceded over 95% of global monthly crypto derivatives volume to offshore venues.

Global Market Opportunity

The global crypto derivatives market approaches **$23 trillion** in annual volume. This new CFTC clarity aims to repatriate a significant portion of this volume—which is currently over 95% offshore—into U.S. regulated markets.

That lag ends now. On December 8, 2025, the Commodities Futures Trading Commission (CFTC) initiated a crucial three-month pilot program. This program permits Futures Commission Merchants (FCMs) to accept Bitcoin (BTC), Ethereum (ETH), and USDC as margin collateral for derivatives contracts.

This is a watershed moment for institutional adoption. It establishes a clear, regulated pathway for U.S. financial firms to leverage their existing crypto holdings, creating a profound 'multiplier effect' on capital efficiency and overall market activity. The market structure changes today.

📈 Capital Efficiency: The Institutional Multiplier

The Core Benefit: Unleashing Capital

The rule’s core benefit removes a significant friction point. Previously, firms **had to liquidate** high-potential crypto assets for cash or equivalent low-yield collateral, creating a substantial opportunity cost. An institution holding significant crypto assets was forced to convert a high-growth asset into a stable, low-yield one to satisfy margin requirements for a derivatives trade.

Now, institutions **use** their existing crypto holdings (BTC, ETH, USDC) directly as margin. This creates a “multiplier effect” on capital deployment. The capital that was previously locked or inefficiently deployed now remains invested in high-growth crypto assets while simultaneously backing a derivatives position. **One dollar performs two functions at once.**

Statistical Evidence of Adoption

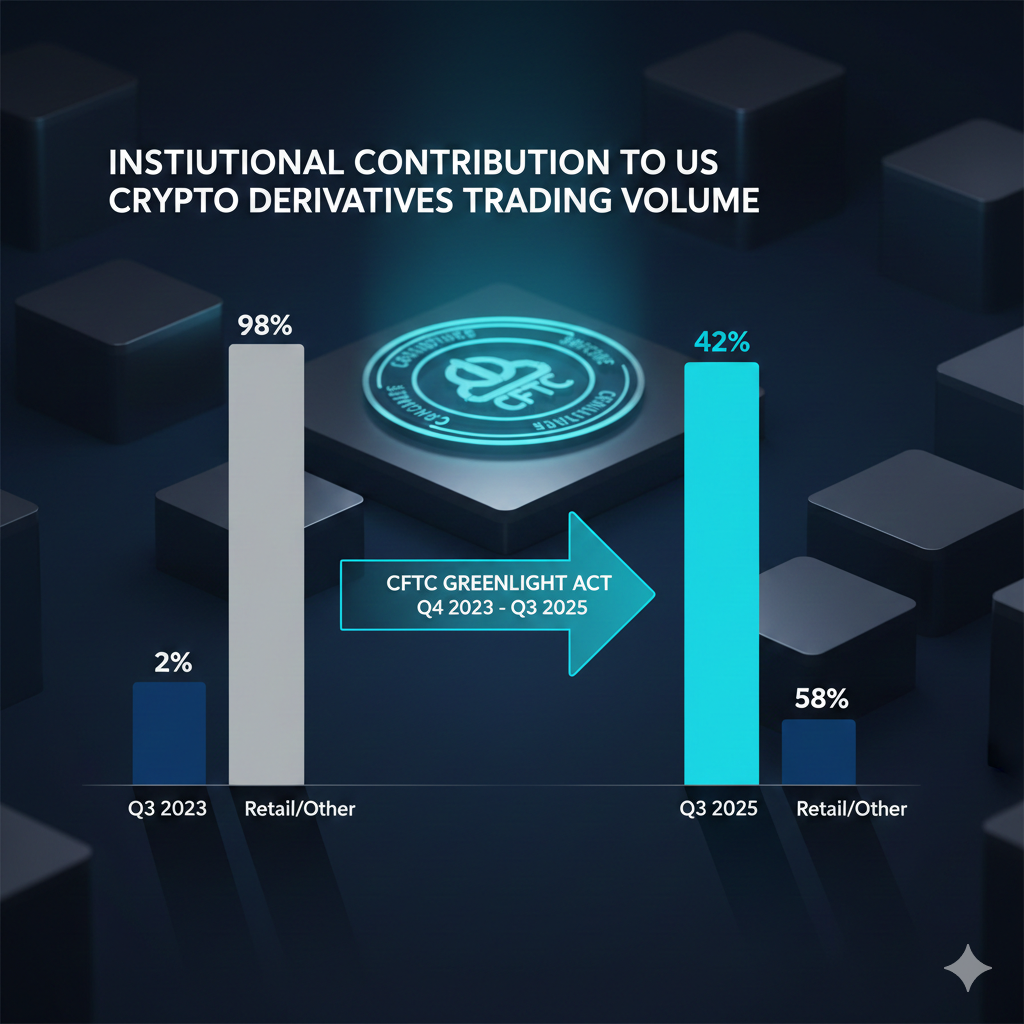

Growing institutional interest laid the groundwork for this decision. Institutional contributions to crypto derivatives trading volume reached approximately **42% in Q3 2025**, a substantial increase from negligible levels two years prior. Furthermore, the CME Group, a bellwether for U.S. institutional activity, reported record-breaking crypto derivatives activity in Q3 2025, with combined futures and options volume exceeding $900 billion.

This new collateral rule accelerates an already established trend.

The Role of USDC and Stablecoin Clarity

The inclusion of USDC is strategic. The stablecoin market surged to an all-time high of over $290 billion in Q4 2025, heavily accelerated by the **GENIUS Act** (signed July 2025). This Act provided a clear federal framework for payment stablecoins. It positions USDC as a highly reliable, less volatile collateral asset that still benefits from the digital assets' 24/7 settlement mechanism.

For institutions minimizing collateral risk while maximizing efficiency, USDC offers a compelling middle ground between the capital gain potential of BTC/ETH and the stability of cash.

⚖️ The Mandated Framework

Mechanism of the Pilot Program

The CFTC's three-month pilot program allows regulated entities—specifically **Futures Commission Merchants (FCMs)**—to accept the three specified digital assets as margin for client derivatives positions. Legislative clarity from the GENIUS Act made this possible.

Crucially, the CFTC simultaneously withdrew **Staff Advisory 20-34**, a 2020 directive that had severely restricted the holding of virtual currencies in segregated customer accounts. Removing this barrier unblocks the operational mechanisms necessary for implementation.

Operational Requirements and Risk Management

Increased efficiency demands increased responsibility. The CFTC mandated stringent risk management requirements for participating FCMs:

- **Weekly Reporting:** FCMs **must file** weekly reports on their digital asset holdings.

- **Immediate Disclosure:** FCMs **must disclose** any operational disruptions immediately.

- **Conservative Haircuts:** FCMs **must apply** the most conservative haircut percentage across all Derivatives Clearing Organizations (DCOs) to account for volatility. This safety buffer—where the collateral value is treated as a percentage (e.g., 80%) of its market price—is essential to shield the system from sudden price drops.

The 24/7 Settlement Advantage

Digital collateral offers a continuous, 24/7 technical advantage. Traditional collateral moves through banking infrastructure, adhering to business-day schedules. This creates a dangerous exposure window, particularly during weekend market turmoil (the "Sunday morning drop").

Crypto collateral, by contrast, allows for real-time transfer and settlement. This enables continuous margin adjustments, letting firms post additional collateral immediately during stress events. **This technical shift fundamentally improves risk management.**

⚠️ Analyzing the Risks: Volatility, Margin Calls, and Dual Exposure

The Primary Operational Risk: Collateral Volatility

While the benefits are clear, we must address the risks. The primary operational risk is **collateral volatility**. This mechanism introduces a **dual market exposure** for a trader.

Traders using BTC collateral for a USD-settled contract face simultaneous market exposure: the intended derivatives position risk, and the unintended price risk of the posted BTC/ETH. A sharp, sudden drop in the value of the pledged BTC or ETH **reduces** the margin ratio, potentially triggering a margin call or even liquidation, even if the derivatives position itself performs neutrally. This risk demands constant vigilance.

“The CFTC's Pilot for Digital Asset Collateral is 'Massive.' It's a tectonic shift, but one that requires sophisticated real-time risk modeling,” **according to Markets Media.**

Complexity and Best Practices for FCMs

This rule requires significant internal system upgrades for FCMs. Their internal systems **must handle** continuous, 24/7 settlement and dynamic collateral valuation. Waiting for Monday morning to reconcile balances is no longer an option.

Actionable advice for firms: **Emphasize** conservative haircut strategies and robust, real-time monitoring systems that instantly detect and notify of margin ratio deterioration.

// Pseudocode for Real-Time Haircut Calculation

function calculateMarginCollateral(assetPrice, haircutPercentage) { const adjustedValue = assetPrice * (1 - haircutPercentage); return adjustedValue; } // Example: BTC at $60,000, 20% Haircut let btcValue = 60000; let conservativeHaircut = 0.20; let availableMargin = calculateMarginCollateral(btcValue, conservativeHaircut); // availableMargin will be $48,000 🔮 Future Outlook: Shifting the Global Derivatives Landscape

The Great Volume Migration

The most immediate and powerful prediction is the great migration of institutional capital and trading volume. With regulatory clarity and enhanced capital efficiency, U.S. regulated exchanges are highly competitive against offshore platforms. We anticipate a significant portion of that **95%+ offshore global volume** will seek the greater customer protection and regulatory certainty offered by U.S. markets.

The Expansion of Tokenization

The CFTC also issued accompanying guidance on tokenized collateral for Real-World Assets (RWAs), alongside the BTC/ETH/USDC pilot. This includes tokenized U.S. Treasury securities and money market funds. This move **will deepen** liquidity, promote fractional ownership of these assets, and integrate their instantaneous, 24/7 settlement into the broader collateral management ecosystem. **This is the next frontier of on-chain finance.**

The Next Frontier: 24/7 Trading Integration

The CFTC's approval aligns perfectly with the future of trading infrastructure. CME Group, for instance, plans a full launch of 24/7 crypto derivatives trading in early 2026. This convergence—**24/7 collateral + 24/7 trading**—fundamentally changes the derivatives market by integrating continuous operation and real-time risk management as the new industry standard.

Regulatory Synergy and Coordination

The long-term trajectory depends on effective coordination between the CFTC and the SEC on future comprehensive rulemaking, such as a potential "Regulation Crypto." Consistent, harmonized rules across the U.S. **will unlock** the full potential of this market.

⭐ Our Verdict: The Regulatory Leap

The CFTC’s greenlight on Bitcoin, Ethereum, and USDC as margin collateral is more than a policy change; it is a massive regulatory leap forward. It fundamentally boosts capital efficiency for sophisticated firms and positions the U.S. to lead the global crypto derivatives market.

Key Takeaways

- **Capital Efficiency:** Institutions now **use** BTC, ETH, and USDC holdings as margin, avoiding liquidation and unlocking capital for other deployments (the "multiplier effect").

- **Regulatory Clarity:** The pilot, enabled by the GENIUS Act and the withdrawal of Staff Advisory 20-34, provides the necessary legal framework.

- **24/7 Advantage:** Digital collateral enables continuous, real-time margin settlement, significantly mitigating exposure windows during non-business hours.

- **Amplified Risk:** The primary challenge is managing the dual market exposure to collateral volatility, which requires stringent and conservative haircut methodologies.

- **Market Shift:** The clarity **will drive** significant global crypto derivatives volume from offshore platforms to U.S.-regulated exchanges.

Institutions and derivatives traders **must immediately assess and upgrade** their internal systems and risk models. The 24/7 market is imminent, and preparedness is the only way to capitalize on this momentous shift. The approval sets a powerful and lasting precedent for the acceptance of digital assets at the highest levels of mainstream finance and collateral management.