TL;DR (The Quick Deployment)

Economic growth operates on a four-phase cycle: Expansion, Peak, Contraction (Recession), and Trough. Financial resilience demands early identification of the shift. Monitor the Inverted Yield Curve (the bond market's canary), the Leading Economic Index (LEI), and the Sahm Rule Indicator (the unemployment tracker). Implement a non-negotiable action plan: establish a 3–6 month emergency fund, eliminate high-interest debt, and adhere to a diversified, long-term investment strategy. Prepare, do not panic-sell.

Who This Is For

This article is for the financially proactive individual—the one who understands that a resilient personal balance sheet is built on foresight, not luck. If you manage complexity in your professional life and seek to apply that disciplined, architectural thinking to your finances, this guide provides the necessary framework.

1. Introduction: Building a Resilient Financial Architecture

Are you financially prepared for the next economic storm? Or does the latest positive GDP report mean you can deploy your budget without considering rollbacks? Hope is not a strategy.

Economic growth, like cloud environment performance metrics, is not a linear, ever-upward trajectory. It is a natural, recurring cycle of boom and bust. Understanding the underlying rhythm of the economy—the business cycle—constitutes the first and most critical step in proactive financial planning.

This guide demystifies the four phases of the business cycle, details the leading economic indicators that function as your early warning system, and provides an actionable, technical plan to recession-proof your financial future. We shift your approach from reactive "break-fix" to proactive, reliable financial architecture.

2. The Four Phases of the Economic Business Cycle

The Economy's Rhythm

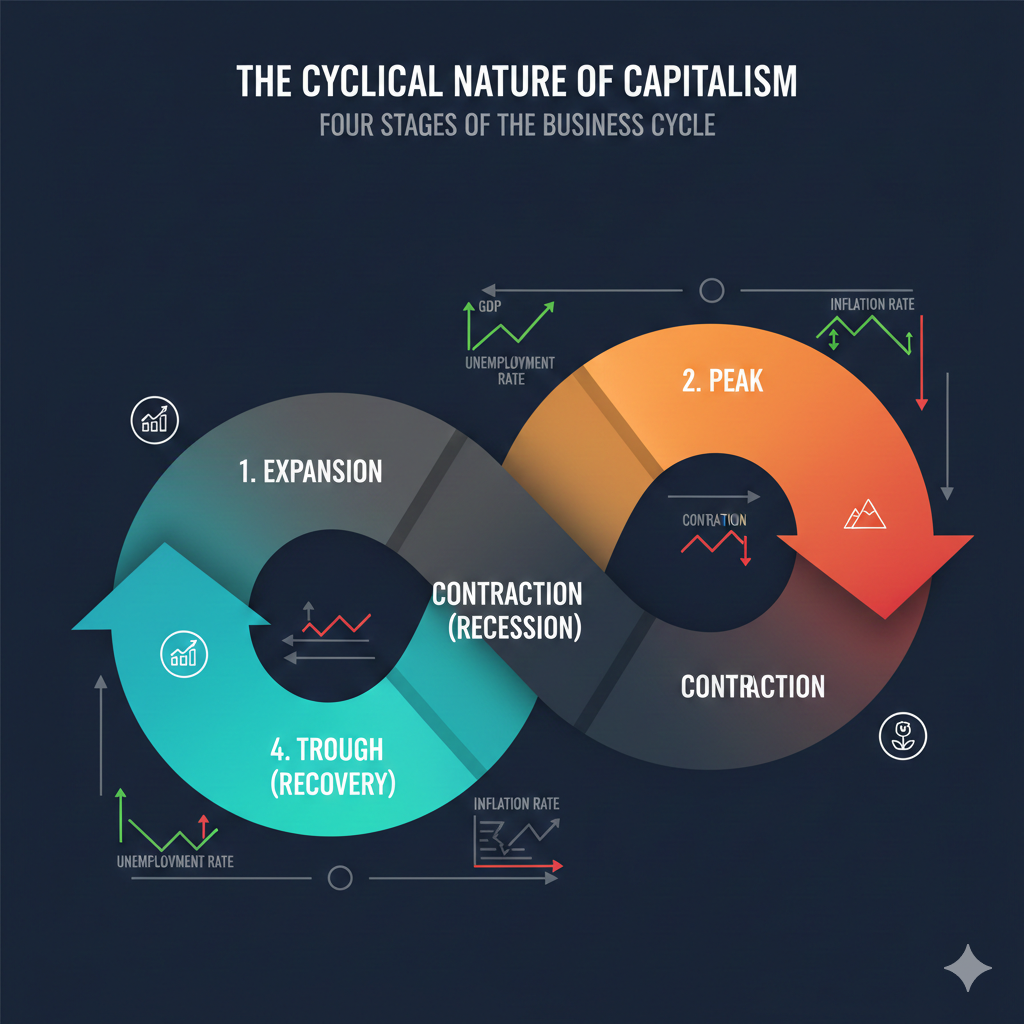

View the business cycle as a state machine with four distinct, recurring states. The system constantly transitions between these phases, driven by market forces, consumer confidence, and investment decisions.

- Expansion: The economy's happy path. Production increases, unemployment remains low, and consumers spend freely. Be wary of financial overextension and overheating during this phase.

- Peak: The high water mark. The economy hits its ceiling. Inflation is high, and expansionary pressures stall. A transition to the Contraction phase is imminent.

- Contraction (Recession): The inevitable decline. This phase features decreased output, rising unemployment, falling wages, and reduced consumer spending. Businesses cut costs and postpone capital investment.

- Trough: The bottom. The lowest point of economic activity before the system initializes the recovery and begins the next Expansion.

Historical Context & Duration

Historically, the contraction phase is significantly shorter than the expansion. Since 1945, the average US recession lasted approximately 10.3 months, while the average expansion stretched to a generous 64.2 months. The 2007–2009 recession was the outlier, lasting 18 months. The downturn is severe, but it is a time-bound stage.

The National Bureau of Economic Research (NBER) officially dates US business cycles, defining a recession as "a significant decline in economic activity that is spread across the economy and lasts more than a few months."

3. Spotting a Recession: Leading Economic Indicators (LEIs)

Just as you track CPU utilization and latency, economists track Leading Economic Indicators (LEIs). These metrics anticipate a business cycle turning point, providing a critical window—sometimes 6 to 24 months—for you to re-architect your personal finances. Ignore them at your peril.

The Inverted Yield Curve (The Bond Market Signal)

This is often the most reliable "check engine light" for the economy. It occurs when short-term bond yields (e.g., the 2-year Treasury) climb higher than long-term yields (e.g., the 10-year Treasury). This backward phenomenon signals that investors expect lower interest rates in the future—a clear sign of an imminent recession that compels the Federal Reserve to cut rates to stimulate the economy. Historically, an inverted yield curve has preceded every US recession since 1955, with a lead time of 6 to 24 months.

The Conference Board Leading Economic Index® (LEI)

If the yield curve is your single metric alert, the LEI is your comprehensive monitoring dashboard. This composite index, comprised of 10 components (including initial unemployment claims, new orders, and consumer expectations), anticipates turning points by about seven months. A sustained, three-month decline in this index signals a serious warning.

The Sahm Rule Indicator (The Unemployment Signal)

This simple, elegant rule signals a recession's start when the three-month average unemployment rate rises 0.5 percentage points or more above its 12-month low. It tracks the acceleration of job loss—a clear, real-world symptom of economic stress and decline.

Other Key Metrics to Monitor

- Gross Domestic Product (GDP): While a lagging indicator, two consecutive quarters of declining real GDP is the commonly used, though unofficial, definition of a recession.

- ISM Manufacturing Index: A reading below 50 indicates that manufacturing activity is contracting, which often spills over into the broader economy and employment.

4. Personal Financial Preparedness: Recession-Proofing Your Future

When indicators flash red, shift from expansion-phase spending to contraction-phase defense. The objective is resilience—creating a personal financial infrastructure that absorbs a shock (like job loss) without catastrophic failure.

Pillar 1: Build and Bolster Your Emergency Fund

Your emergency fund is your primary firewall. Keep it liquid and accessible, not tied up in volatile investments.

- The Standard: Save 3 to 6 months of basic living expenses.

- High-Risk Target: If you are self-employed, work on commission, or operate in a high-turnover industry, aim for 9 to 12 months.

- Location: Keep these funds in a liquid account, specifically a high-yield savings account (HYSA).

Pillar 2: Stress-Test Your Budget and Tackle Debt

Perform a comprehensive budget audit. Separate essential (rent, basic groceries) from discretionary (dining out, streaming subscriptions) expenses. Identify non-essentials you can cut or delay. Apply aggressive automation to debt reduction.

Prioritize paying down high-interest, revolving debt (e.g., credit cards) first. Eliminating this debt lowers your mandatory monthly outflow and significantly reduces your financial risk exposure.

Pillar 3: Stick to Your Investment Plan

Market volatility remains inevitable during a recession. The single biggest mistake an investor makes is panic-selling. Selling off investments locks in losses and ensures you miss the inevitable market rebound. Ensure your portfolio is diversified (across asset classes, industries, and geographies) and aligns with your long-term time horizon and risk tolerance. Automate contributions and walk away from the daily noise.

Pillar 4: Career and Income Defense

Job loss is the most acute pain point of a recession. Proactive defense is mandatory:

- Update your resume and portfolio now.

- Invest in skills and certifications that are resilient (e.g., security, infrastructure maintenance, data science).

- Proactively network. The best time to build relationships is when you do not need them.

- Develop a side gig for additional income diversification.

5. Consumer Behavior During Economic Contractions

When the economy contracts, consumer psychology shifts from "achieving gain" (approach motivation) to "avoiding loss" (avoidance motivation). This impacts the entire retail and service landscape.

Shift in Spending Habits

Consumers become highly risk-averse. They postpone or cancel spending on big-ticket durables (cars, appliances). Instead, people prioritize essential goods, dramatically increase comparison shopping, and trade down to lower-priced alternatives or private labels to stretch their dollars.

Digital adoption can accelerate during economic pressure as consumers actively seek better prices, comparison tools, and convenience online.

When capital is tight, the wallet becomes highly opinionated. Every purchase is scrutinized, and value becomes the absolute primary feature.

6. Conclusion: Deploying Your Financial Strategy

The business cycle is a force of nature, not a failure of the system. Your objective is not to stop the tide but to build a seaworthy vessel. By understanding the four phases and paying attention to the leading indicators, you gain the most valuable commodity in finance: time.

The time to shore up your emergency fund, pay down high-interest debt, and review your career resilience is today, while the expansion continues. Do not wait for the Inverted Yield Curve to shout at you.

Our Verdict

- The Cycle is Natural: Economic expansion always gives way to contraction, and then back to expansion.

- Monitor Your Metrics: Use the Inverted Yield Curve, the LEI, and the Sahm Rule Indicator as your personal financial monitoring dashboard.

- Prioritize Resilience: Build a 3–6 month (or more) liquid emergency fund and pay down high-interest debt.

- Stay Invested: Do not panic-sell. Adhere to your diversified, long-term investment plan.

Keep an eye on the horizon. Structural factors like AI and government intervention are new variables that may alter the interpretation of traditional recession indicators in future cycles. The game evolves, but the necessity of preparedness remains constant.

Now, review your current budget and confirm your emergency fund amount. Deploy the changes!