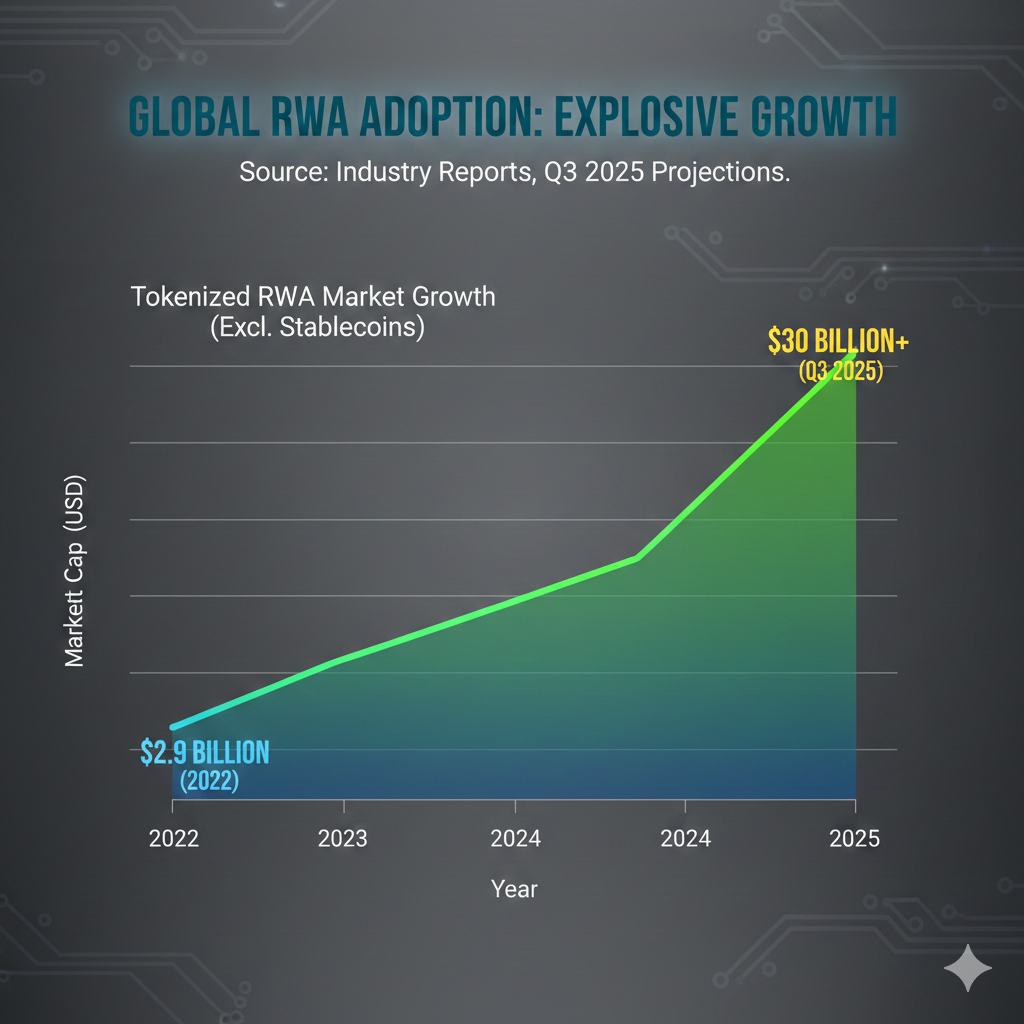

TL;DR: The landmark $2 billion initiative between Binance and Pakistan to tokenize state-owned assets (bonds, T-bills, commodities) and explore a sovereign stablecoin validates blockchain's institutional utility. Pakistan positions itself as a model for emerging markets modernizing finance. This strategic pivot aligns with the global Real-World Asset (RWA) market, which surged from $2.9 billion in 2022 to over $30 billion by Q3 2025, primarily driven by tokenized U.S. Treasuries and private credit. Successful national adoption demands robust KYC/AML compliance and technical interoperability for seamless settlement.

Who This Is For

This analysis targets institutional investors, financial regulators, and technologists tracking the transition of sovereign and traditional finance onto blockchain rails. It provides a definitive assessment of the technical, regulatory, and market dynamics driving the next wave of global financial infrastructure.

The Sovereign Blueprint: Pakistan's $2 Billion Tokenization & Stablecoin Plan

The Memorandum of Understanding (MoU) signed between Binance and Pakistan signals a decisive sovereign pivot toward the blockchain economy. This nation-building effort seeks to tokenize up to $2 billion in state-owned assets, including sovereign bonds, treasury bills, and commodity reserves (oil, gas, and metals).

This initiative secured crucial regulatory green lights, a non-negotiable step for institutional-grade adoption. Pakistan's Virtual Assets Regulatory Authority (PVARA) issued initial No Objection Certificates (NOCs) to both Binance and HTX. These certificates allow the entities to begin local incorporation and establish the foundation for full operational licensing. Regulatory clarity provides the essential basis for large-scale, trustworthy tokenization.

Successful deployment of tokenized Real-World Assets (RWA) at a national scale necessitates a high-quality, reliable settlement layer—the Sovereign Stablecoin. Its critical function is to act as the primary, risk-free instrument for instant settlement and collateral management within the tokenized RWA ecosystem. By exploring a national stablecoin, Pakistan aims to eliminate complex, slow, and expensive reliance on traditional cross-border settlement mechanisms, providing the high-speed liquidity necessary to make tokenized assets truly functional.

Explosive Growth and Institutional Validation of Global RWA

Pakistan's strategy perfectly aligns with a global financial market undergoing transformation. While the concept of representing ownership is not new, its modern application via blockchain creates unprecedented value and efficiency.

Tokenized RWA Market Overview and Statistics

Excluding stablecoins, the tokenized RWA market has undergone remarkable growth, soaring from $2.9 billion in 2022 to over $30 billion by Q3 2025. Stablecoins, however, dominate the broader digital asset landscape, commanding over 97% of the total market capitalization, standing at approximately $250 billion in early 2025. This dominance underscores stablecoins’ foundational role as the global digital liquidity layer.

Within the non-stablecoin category, high-quality, low-risk financial instruments lead the rapid diversification. The two largest segments are:

- **Tokenized Private Credit:** Held $15.6 billion in early 2025.

- **Tokenized U.S. Treasuries:** Exceeded $6.7 billion in early 2025.

BlackRock's Ethereum-based BUIDL tokenization fund, focused on U.S. Treasuries, reached between $1.8 billion and $2.28 billion across multiple blockchains. A traditional finance giant like BlackRock utilizing the Ethereum Virtual Machine (EVM) ecosystem—which currently accounts for 77% of RWA value on public blockchains—sends an unambiguous signal: RWA is a core, emerging component of modern global financial infrastructure. Financial institutions in about 80% of reviewed jurisdictions announced new digital asset initiatives in 2025, a trend driven by increasing global regulatory clarity.

Technical Mechanics and Key Challenges of National Tokenization

How Asset Tokenization Works

Asset tokenization creates a secure, fractional, and digital representation of real-world asset ownership rights (e.g., a government bond) on a Distributed Ledger Technology (DLT) or blockchain. The primary strategic drivers for national adoption are clear:

- Enhance Liquidity: Previously illiquid or locked assets become instantly and globally tradable.

- Improve Transparency: An immutable, auditable ledger provides transparent ownership and transaction records.

- Reduce Costs: Eliminating multiple traditional intermediaries simplifies complex back-office processes.

- Faster Settlement: Settlement times reduce from several days (T+2 to T+5) to seconds or minutes.

The Technical and Compliance Roadmap

For a national-level project, the choice of technology and compliance framework dictates success. The EVM ecosystem is the current technical favorite due to its maturity, robust developer base, and existing liquidity, which accounts for the vast majority of RWA value. However, institutional trust relies not on the underlying technology, but on adherence to global regulatory standards.

Implementation requires robust, scalable Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures. This compliance infrastructure ensures the system is legally secure and trustworthy, providing necessary assurances for both domestic and global institutional capital.

Settlement and Interoperability Hurdles

The key technical challenge remains the lack of a high-quality, risk-free settlement asset and interoperability across different blockchains. Projects like Project Helvetia, which explore the use of wholesale Central Bank Digital Currency (CBDC), are critical experiments attempting to provide a risk-free, central-bank-backed settlement asset that operates seamlessly across various tokenized markets. This layer is essential to realizing the full potential of instant RWA trading.

User Benefits, Regulatory Pain Points, and Future Implications

Benefits: Democratization and Efficiency

Tokenized RWA offers transformational benefits for the global investor. Tokenization allows for fractional ownership, breaking down financial barriers and democratizing access to high-value sovereign assets previously exclusive to large institutions. The ability to trade 24/7 with near-instant settlement dramatically contrasts with the traditional financial system, making global liquidity efficient and accessible.

Pain Points: Regulation and UX

Significant hurdles persist. The complexity of cross-border regulatory uncertainty is a major pain point, as jurisdictions classify and govern tokenized assets differently. This lack of harmonization complicates global investment and compliance for institutional actors. Furthermore, while platforms improve, the technical complexity of secure self-custody and the overall user experience (UX) still present adoption barriers for mass consumers.

“The total value of the tokenized RWA market is widely forecasted to reach significant figures by the end of the decade, with projections ranging from $3.5 to $16 trillion by 2030.”

Future Outlook: The Trillion-Dollar Projection

The consensus across the financial sector is that the tokenized RWA market is on an exponential trajectory. Forecasts reaching up to $16 trillion by 2030 signify the sector's move from an emerging idea to a major, established component of global finance. Pakistan's initiative signals a growing trend among emerging economies: they must utilize RWA and sovereign stablecoins as new financial rails to boost domestic liquidity, expand international market access, and improve global economic inclusion and efficiency.

Comparison: Traditional vs. Tokenized Asset Settlement

| Feature | Traditional Asset Settlement (e.g., International Bond) | Tokenized Asset Settlement (Blockchain) |

|---|---|---|

| Settlement Time | T+2 to T+5 days (International transfers can be longer) | Seconds to Minutes |

| Ownership | Centralized ledger (Custodian banks, clearing houses) | Decentralized Ledger (DLT/Blockchain) |

| Access | Generally limited to institutions and high-net-worth individuals | Democratized via Fractional Ownership |

| Transparency | Limited visibility into full transaction chain | High (Auditable on the public/permissioned ledger) |

Our Verdict

The Binance/Pakistan $2 billion RWA initiative is a **landmark sovereign move** that sets a critical regulatory and technical precedent for emerging markets to modernize finance. The RWA market, excluding stablecoins, has grown over 10x since 2022, with tokenized U.S. Treasuries and private credit driving high-value institutional adoption. Successful national tokenization requires not just cutting-edge blockchain (likely EVM-based) but, more importantly, **robust, scalable KYC/AML compliance** to secure institutional trust. Tokenization fundamentally increases asset liquidity and democratizes access for global investors, shifting financial power to a broader base.

The focus now must track the regulatory progress within Pakistan's PVARA and the technical execution of the Binance partnership. This case study will define the roadmap for countless emerging markets looking to leverage innovation for sustainable, efficient growth and economic opportunity.