TL;DR

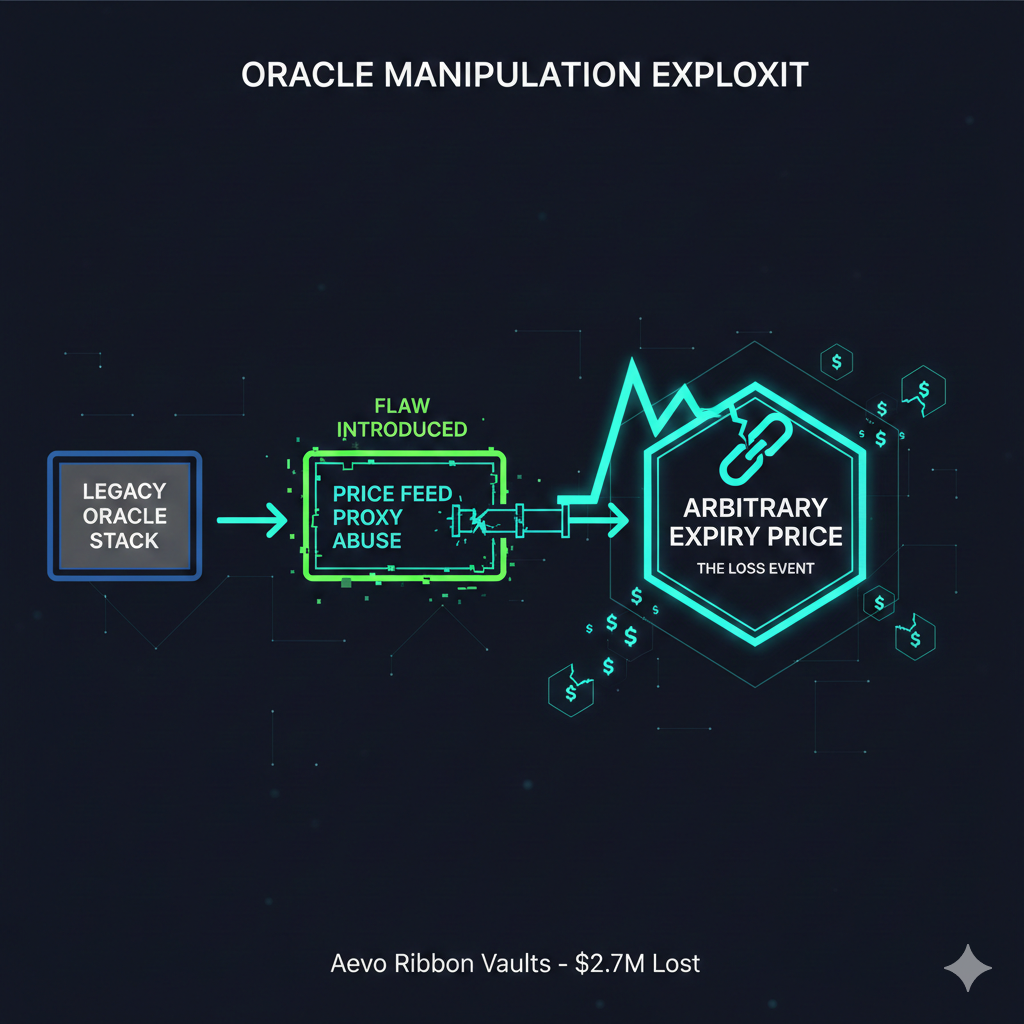

A $2.7 million exploit occurred on Aevo's legacy Ribbon DeFi Options Vaults (DOVs) on December 12, 2025. The attack was enabled by a vulnerability introduced during an oracle infrastructure upgrade, which allowed the attacker to manipulate price-feed proxies and inject arbitrary expiry prices for multiple assets. This incident, while demonstrating a smaller scale of total loss compared to Access Control exploits, highlights the **critical, high-impact threat of Oracle Manipulation** in protocols maintaining legacy components and mandates a security pivot toward robust oracle resilience or genuinely oracle-free architectures for systemic DeFi stability.

The decentralized finance (DeFi) ecosystem was recently affected by the loss of approximately $2.7 million from Aevo's legacy Ribbon DeFi Options Vaults (DOVs). This financial depletion was not the result of a zero-day contract flaw but a vulnerability directly tied to an oracle infrastructure upgrade within the older smart contracts. This incident serves as a crucial, costly reminder of the technical and operational risks associated with price oracles, especially when they intersect with multi-generational or legacy protocol environments.

Aevo, having undergone a rebrand from Ribbon Finance and a strategic transition to a Layer 2 derivatives exchange, maintained these legacy Ethereum-based DOV vaults. Oracles are the crucial technical bridge, or data feed, that connects off-chain, real-world data (such as asset prices or event results) to on-chain smart contracts. For structured products like DOVs—which rely on precise, externally sourced pricing for option settlement—the oracle's integrity is paramount.

The Exploit: Anatomy of an Oracle Attack

Targeting the Legacy System's Weak Point

The exploit specifically targeted the legacy Ethereum-based smart contracts of Ribbon Finance's DOVs. Despite the protocol's primary focus shifting to the Aevo Layer 2 derivatives exchange, these older systems—which once held over **$300 million in Total Value Locked (TVL)** during the DeFi market peak—remained active and vulnerable. The continued operation of these un-decommissioned systems created a significant systemic risk.

The Mechanism of Manipulation

The core technical vulnerability that enabled the attack was a flaw introduced during a seemingly benign **oracle infrastructure upgrade**. The attacker leveraged this weakness to manipulate the underlying Opyn/Ribbon oracle stack.

The attack vector involved the abuse of **price-feed proxies**. By successfully exploiting this proxy architecture, the attacker gained the ability to push **arbitrary expiry prices** for several underlying assets, including wstETH, AAVE, LINK, and WBTC, into the shared oracle at a common, specific expiry timestamp. This manipulation of critical settlement data led directly to the unauthorized draining of funds and the total loss of $2.7 million.

Systemic Oracle Risk in DeFi

Quantifying Oracle Manipulation in the Market

While the dollar value is substantial, it is crucial to position Price Oracle Manipulation within the broader context of smart contract security vulnerabilities. Reports for 2024 indicate approximately **$8.8 million in losses** due to Price Oracle Manipulation attacks. For comparison, the largest loss vectors included:

- Access Control Vulnerabilities: **$953.2 Million**

- Logic Errors: **$63.8 Million**

This data confirms that oracle manipulation is not the largest vector by sheer volume or total capital loss. However, its high-impact, targeted nature makes it an enduring, critical risk, specifically undermining the economic security of complex, derivatives-based products.

Overall, smart contract exploits cost institutions over **$1.2 billion in 2024**, signifying an environment where every vulnerability class is a material concern.

The Operational Risk of Legacy Components

This Aevo/Ribbon exploit highlights a critical operational risk for all migrating protocols: the failure to fully and securely decommission legacy smart contracts. When core infrastructure components, such as the oracle stack, are shared or interact with older systems, an upgrade can inadvertently introduce a regression vulnerability that affects the retired system.

Industry analysis from sources like SQ Magazine's 2025 analysis suggests that price feed risk is a major driver for institutional crypto investors. It is capable of triggering large, unexpected margin calls in complex DeFi trades.

For institutional investors, the integrity of the price feed is non-negotiable, as an exploited oracle can immediately and drastically alter collateral values or settlement prices, leading to systemic failure or unexpected, large-scale margin calls.

Protocol Response and Future Trajectories

Managing User Losses and Protocol Decommissioning

The incident resulted in an approximate **32% loss** on the value of the affected vaults. The Aevo team quickly proposed a mitigation plan to reduce the financial impact on active users.

Key Takeaway: Loss Mitigation Strategy

As reported by the Aevo team's proposal, the initial vault loss was $\approx 32\%$. The Aevo DAO agreed to forfeit $\approx \$400,000$ of its own vault positions to absorb a portion of the loss. This action reduced the effective "haircut" for users to $19\%$, prioritizing active depositors and resulting in a net protocol loss of $\approx \$2.3$ million.

The team also issued a stark reminder of inherent DeFi risk, stating that the DAO "never promised or offered insurance on deposits." This emphasizes the necessity for sophisticated users to conduct their own risk assessments. Following the incident, the immediate action taken was the stopping and planned decommissioning of all legacy Ribbon vaults, formally concluding their lifecycle.

The Shift to Decentralized and Oracle-Free Architecture

The exploit renews focus on the industry's long-term solution to the "oracle problem." One emerging trend is the development of **oracle-free protocols**. These systems attempt to fundamentally eliminate price feed risk by designing lending or derivatives architectures that rely on internal mechanisms (like clearing house models or time-weighted average prices) rather than external, manipulable data feeds.

However, Oracles are expected to remain critical, especially for dynamic financial products and the integration of real-world assets (RWA). This necessitates an emphasis on improved decentralized oracle resilience. Current market data shows that the oracle provider market is highly concentrated, with a single major provider accounting for a significant majority of the category's market cap. This concentration introduces a systemic **single-point-of-failure risk** for the entire DeFi ecosystem.

Oracles and Regulatory Compliance

In a future-forward application, oracles are also being explored as a key technical tool for bridging regulatory compliance into smart contracts. By feeding external compliance data—such as AML/KYC checks and sanctions lists—into DeFi applications via atomic transactions, oracles could become essential for institutional adoption and RWA integration. The "oracle problem"—the challenge of balancing complete decentralization with practical efficiency—suggests that DeFi's expansion beyond crypto-native assets may remain limited until more robust, widely accepted oracle solutions are implemented.

Conclusion

The $2.7 million loss on Aevo's legacy Ribbon DOV vaults serves as a pointed, expensive case study in the fragility of critical decentralized infrastructure. It underscores the high-stakes reality that Oracle Risk remains a top-tier systemic threat, particularly when combined with the operational risks inherent in maintaining legacy smart contract dependencies.

For developers, auditors, and investors, the call to action is clear: rigorous audit and security modeling must be applied not only to active contracts but also to the decommissioning and interaction pathways of older systems and shared oracle infrastructure. The future stability of DeFi hinges on a pivotal choice: a massive, sustained investment in the resilience and decentralization of oracle solutions, or a strategic, fundamental pivot toward genuinely oracle-free designs to mitigate systemic risk and facilitate institutional growth.

Key Takeaways

- Legacy System Risk: The exploit was enabled by a vulnerability introduced during an oracle upgrade, affecting the legacy Ribbon vaults, highlighting the danger of active, un-decommissioned systems post-protocol migration.

- Technical Vector: The attack leveraged flaws in the oracle stack's price-feed proxies to push arbitrary settlement prices, leading directly to financial loss.

- Systemic Impact: Price Oracle Manipulation, while smaller in terms of total capital lost compared to Access Control attacks, remains a focused, high-impact vector that can undermine the economic model of complex DeFi products like Options Vaults.

- Future Trajectory: The industry faces a necessary choice between doubling down on robust, decentralized oracle resilience (to enable RWA and dynamic products) and adopting entirely oracle-free architectural designs to eliminate this class of risk.